BetHawk has been trialled twice at Lay Back.

Lucy ran the first trial from 11th July 2013 to 27th February 2014, placing 2,703 bets and banking 159 points of profit.

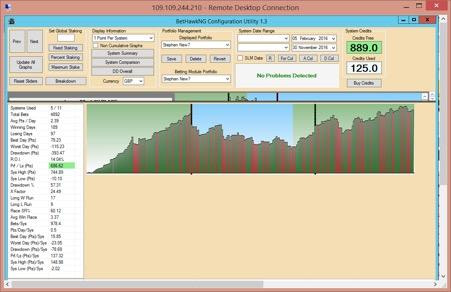

The second was carried out by Stephen from 5th February 2016 to 7th February 2017, this time placing 5,776 bets and returning 696 points of profit.

Needless to say, both reviews saw BetHawk placed in the “passed systems” folder.

But… that’s not quite the end of the story.

User feedback since has been… let’s say… “mixed” with some praising the betting bot and others having a hard time.

Based on the trial results over a total of 19 months, I don’t think that anyone could argue that BetHawk shouldn’t remain as a “passed” system, but…

I urge anyone getting involved to take things steady with a very long-term view.

If you can’t look past bad runs and drawdowns, BetHawk is certainly not for you.

They are going to happen.

On the other hand, if you want to find out more about this automated betting system then read on. After all, both trials did end well in profit.

In this post you will find the full transcripts of both trials, along with results and conclusions from Lucy and Stephen. It’s a looooooooong read but you will get the full 19 months worth of results, thoughts, conclusions, ups and downs.

I can’t imagine a more comprehensive or thorough live, public test. Hats off to both!

If you’d like to find out more about BetHawk itself, you can do so here.

Lucy’s Intro: 11th July 2013

I can think of few things weirder than a betting bot.

It almost seems a contradiction in terms.

After all, horse racing in particular is notoriously random, and robots, presumably by definition, are utterly predictable, slavishly following their designer’s rules.

Can such a random sport really be reduced to a series of programming instructions?

That said, when you think of the enduring appeal of tipsters – which, I believe, comes from how busy most people are, creating the demand for high quality, effortless selections – then I suppose a bot makes some sort of sense.

With a bot you don’t even have to put the bets on yourself!

You just switch on your computer and let it do its thing.

But still. It goes against the grain….

And yes I know I have said things like this before, specifically on the only previous occasion when I tried testing one of these things.

In the end of course, I didn’t have to deal with the philosophical and socio-economic implications of an army of tipsters suddenly being made redundant, as my trial of the Magic Backing Bot ended in disaster. It showed itself to be little more than an automated way of losing money, plus was a total pain to live with, as it seemed to need constant TLC.

I was glad when the whole sorry affair was over and I could go back to normal punting.

With all the above preamble in mind, you will probably be surprised to hear about my new trial of BetHawk.

For in spite of all my reservations, I cannot ignore the fact that this thing appears to deliver real results via a portfolio approach.

And yes, it is that word portfolio that’s hooked me.

Regular readers will know I go on and on about portfolios (Read “Rollingstone”, to find out why).

It is an idea we punters can steal from the financial trading world, to minimise risk, and, importantly, give us a degree of insurance against the pain of losing runs.

Also, unlike my previous failed foray into the world of betting automation, this one does allow some user engagement in order to help you build your portfolio contents.

A cynic might consider this the illusion of control, but I still think it better than no control at all!

So What’s Inside The Box?

BetHawk essentially provides a range of systems from which you select the ones that appeal most to you.

This might seem a bit silly, because surely everyone will simply want the most profitable systems. But it really isn’t as simple as that.

You may for instance be prepared to trade off some profit for an improved strike rate.

Or perhaps you prefer to focus on long-term return on investment, and may be prepared to live with the fact that a given system has struggled recently.

In any event, you simply select from a long list those systems that have features that appeal to you, and bundle them together into a portfolio.

Then, as far as I can tell, all you do is press the magic go button, and sit back and wait. 🙂

There is apparently also the option to monitor individual systems for a period of time, before you decide to buy in.

The monitoring aspect is free, and can, it appears, be run indefinitely, or, more realistically, until such time as you’re convinced this is something you’d like to invest real money in.

Which, if nothing else, is a damned impressive sales technique!

So Here Goes…

I’m going to set up the tool on my PC over the next couple of days…

….build my portfolio…

… then kinda look at it for a bit…

… then kick off the trial!

It all seems very straightforward.

And of course utterly mystifying.

Update: 8th August 2013

It’s just under a month since I wrote my introductory post about the BetHawk bot.

And here I am, 246 bets down the line, already wondering if I should wind up the trial….

This is not an easy report to write. Because my emerging view is that this product may be beyond testing.

As I said in my opening post, I don’t really understand betting bots.

And now, 246 bets later, I have to say… I still don’t.

For me (and maybe it’s a personal thing), the whole point of a successful betting system should be the exploitation of an “edge”.

An edge being the reason why the system is believed to work in the first place.

For instance…

Maybe you believe you can profitably lay horses on the all-weather track at Southwell, if, say, they have no previous experience of its sapping fibresand.

Thus the market may be under-pricing runners with experience of other all-weather tracks, and not taking adequate notice of Southwell’s unique surface.

Thus, this belief would become your “edge”.

And if you could find enough winners over the long term by laying in this way, your belief in the edge would sustain you during the occasional losing run.

Which brings me back to BetHawk.

Because losing runs with bots are a bit of a nightmare.

I don’t know why I should believe in them, because I have no idea what the edge is supposed to be.

The opaque nature of betting bots tries my faith to the point where I find them almost impossible to live with.

After all, this thing is spending my money, but not telling me how it’s making its decisions!

OK – so how are we doing overall?

You might think I’m going tell you BetHawk‘s been a disaster… but it hasn’t.

After 246 bets, I have lost just 5.5 points, by using 2 point stakes.

In effect, it’s a draw.

But I’m afraid my point still stands.

I can see no clear pattern in the bets, and therefore no real “reasons to believe”.

The prices taken offer no clue, with winners to date ranging from 1.64 to 12.14.

And race-types include both handicaps and non-handicaps; chases, hurdles and flats; quick dashes and long canters.

Now I haven’t run BetHawk all day every day — I do have to go out sometimes ! — and of course, I have only selected a subset of systems from the many options available in the product’s portfolio.

But the ones I have chosen were personally recommended to me by the system provider, so I have to say overall performance so far has been slightly disappointing.

However, it is quite likely that another user, selecting other systems, and running at different times of the day, might have obtained far better – or worse – results.

It also doesn’t help matters that the strike rate has been a shade under 20%. So long, losing runs have very quickly become a fact of life.

However, that said, there are a lot of bets each day, so a “long losing run” might last more than ten bets but only take three hours!

I normally test systems for 200 bets, as this number, in my mind, represents a sort of trade-off between statistical robustness on the one hand, and the sheer hassle of trialling on the other.

So clearly, at 246 bets placed, I’m there already.

Plus, as I have no idea what this thing is doing anyway, I am even more tempted to call it a day.

However!..

Now that the system is set up, there is almost no effort involved in actual trialling (other than remembering to switch it on!), so I have decided, in spite of my reticence, to let BetHawk run for another 250 bets or so.

If we can get to 500 bets, I think I’ll have given it a fair old go.

What I can say unequivocally is that I have found Keith @ Acebots to be tremendously helpful and courteous, and determined to provide a good quality service.

And I so want to see it work!

And even more, I would love to know what the hell it’s doing with my money!

I’ll be back in a month or so with a conclusion.

In the meantime, the complete results log for the BetHawk trial looks like this…

| BetHawk Bet Log | |||||

| race | race time | race profit | race bets | winning bets | win price |

| Horse Racing / Kemp 7th Aug : 7f Mdn Stks | 07-Aug-13 19:00 | -2 | 1 | ||

| Horse Racing / Yarm 7th Aug : 6f Hcap | 07-Aug-13 18:50 | 5.1 | 1 | Big Wave | 3.71 |

| Horse Racing / Kemp 7th Aug : 1m4f Hcap | 07-Aug-13 18:30 | -2 | 1 | ||

| Horse Racing / Yarm 7th Aug : 1m Hcap | 07-Aug-13 18:20 | -4 | 2 | ||

| Horse Racing / Brig 7th Aug : 6f Hcap | 07-Aug-13 17:55 | 6.8 | 2 | Koharu | 5.6 |

| Horse Racing / Yarm 7th Aug : 7f Hcap | 07-Aug-13 17:50 | -4 | 2 | ||

| Horse Racing / Newc 7th Aug : 1m2f Hcap | 07-Aug-13 17:35 | -4 | 2 | ||

| Horse Racing / Brig 7th Aug : 1m2f Hcap | 07-Aug-13 17:25 | 14.2 | 2 | Thewinningmachine | 9.52 |

| Horse Racing / Brig 7th Aug : 1m2f Hcap | 07-Aug-13 16:50 | -2 | 1 | ||

| Horse Racing / Ponte 7th Aug : 6f Hcap | 07-Aug-13 17:00 | -4 | 2 | ||

| Horse Racing / Ripon 5th Aug : 1m4f Hcap | 05-Aug-13 17:15 | -2 | 1 | ||

| Horse Racing / Wolv 5th Aug : 1m Mdn Stks | 05-Aug-13 17:00 | 9.2 | 2 | Quantify | 6.83 |

| Horse Racing / Wolv 5th Aug : 1m Hcap | 05-Aug-13 16:30 | -6 | 3 | ||

| Horse Racing / Wolv 5th Aug : 7f Mdn Stks | 05-Aug-13 16:00 | 1.2 | 1 | Satwa story | 1.64 |

| Horse Racing / Ripon 5th Aug : 6f Hcap | 05-Aug-13 15:45 | -2 | 1 | ||

| Horse Racing / Wolv 5th Aug : 7f Nursery | 05-Aug-13 15:30 | -6 | 3 | ||

| Horse Racing / Wolv 5th Aug : 5f Hcap | 05-Aug-13 15:00 | 5.6 | 2 | Little Eli | 6.96 |

| Horse Racing / Ripon 5th Aug : 5f Sell Hcap | 05-Aug-13 14:45 | 8 | 1 | Edith Anne | 5.19 |

| Horse Racing / Wolv 5th Aug : 5f Nursery | 05-Aug-13 14:30 | -4 | 2 | ||

| Horse Racing / MrktR 4th Aug : 2m1f Hcap Hrd | 04-Aug-13 17:35 | -2 | 1 | ||

| Horse Racing / Newb 4th Aug : 1m2f Hcap | 04-Aug-13 16:55 | -2 | 1 | ||

| Horse Racing / MrktR 4th Aug : 2m3f Hcap Hrd | 04-Aug-13 16:00 | 7.7 | 1 | Get Home Now | 5.06 |

| Horse Racing / MrktR 4th Aug : 2m5f Nov Hrd | 04-Aug-13 14:50 | -2 | 1 | ||

| Horse Racing / Newb 4th Aug : 1m2f Hcap | 04-Aug-13 14:10 | -4 | 2 | ||

| Horse Racing / Ling 3rd Aug : 1m2f Hcap | 03-Aug-13 20:30 | -2 | 1 | ||

| Horse Racing / Ham 3rd Aug : 1m Hcap | 03-Aug-13 20:15 | 5.2 | 1 | Teds Brother | 3.77 |

| Horse Racing / Ling 3rd Aug : 1m4f Hcap | 03-Aug-13 20:00 | 3.6 | 2 | Slip Of The Tongue | 3.89 |

| Horse Racing / Ling 3rd Aug : 5f Mdn Stks | 03-Aug-13 19:30 | -6 | 3 | ||

| Horse Racing / Ling 3rd Aug : 6f Hcap | 03-Aug-13 19:00 | -4 | 2 | ||

| Horse Racing / Ham 3rd Aug : 6f Nursery | 03-Aug-13 18:15 | 7.6 | 2 | Its All A Game | 6 |

| Horse Racing / Newt 3rd Aug : 2m5f Hcap Chs | 03-Aug-13 17:40 | -2 | 1 | ||

| Horse Racing / Newt 3rd Aug : 3m3f Hcap Hrd | 03-Aug-13 16:30 | -2 | 1 | ||

| Horse Racing / Thirsk 3rd Aug : 6f Hcap | 03-Aug-13 14:30 | -2 | 1 | ||

| Horse Racing / Donc 3rd Aug : 5f Hcap | 03-Aug-13 14:25 | -2 | 1 | ||

| Horse Racing / Newm 3rd Aug : 7f Hcap | 03-Aug-13 14:20 | -2 | 1 | ||

| Horse Racing / Newm 2nd Aug : 1m Hcap | 02-Aug-13 17:50 | -2 | 1 | ||

| Horse Racing / Bang 2nd Aug : 3m Hcap Hrd | 02-Aug-13 17:35 | -6 | 3 | ||

| Horse Racing / Thirsk 2nd Aug : 7f Hcap | 02-Aug-13 16:40 | -2 | 1 | ||

| Horse Racing / Thirsk 2nd Aug : 7f Hcap | 02-Aug-13 16:05 | -4 | 2 | ||

| Horse Racing / Thirsk 2nd Aug : 7f Claim Stks | 02-Aug-13 14:55 | -2 | 1 | ||

| Horse Racing / FfosL 1st Aug : 1m4f Hcap | 01-Aug-13 20:15 | -2 | 1 | ||

| Horse Racing / FfosL 1st Aug : 5f Nursery | 01-Aug-13 17:40 | 5.6 | 1 | Mselle | 3.95 |

| Horse Racing / Good 1st Aug : 7f Hcap | 01-Aug-13 16:50 | -2 | 1 | ||

| Horse Racing / Strat 1st Aug : 2m4f Hcap Chs | 01-Aug-13 16:40 | -2 | 1 | ||

| Horse Racing / Nott 1st Aug : 1m Mdn Stks | 01-Aug-13 15:55 | -2 | 1 | ||

| Horse Racing / Strat 1st Aug : 2m7f Hcap Chs | 01-Aug-13 15:35 | -2 | 1 | ||

| Horse Racing / Strat 1st Aug : 2m6f Hcap Hrd | 01-Aug-13 14:35 | -2 | 1 | ||

| Horse Racing / Strat 1st Aug : 2m6f Hcap Hrd | 01-Aug-13 14:05 | -2 | 1 | ||

| Horse Racing / Leic 31st Jul : 1m Hcap | 31-Jul-13 20:45 | 8.7 | 2 | Calm Attitude | 6.6 |

| Horse Racing / Leic 31st Jul : 6f Hcap | 31-Jul-13 20:10 | -4 | 2 | ||

| Horse Racing / Redc 31st Jul : 1m Hcap | 31-Jul-13 18:10 | -2 | 1 | ||

| Horse Racing / Sand 31st Jul : 1m Hcap | 31-Jul-13 17:50 | 5.3 | 1 | Ishikawa | 3.78 |

| Horse Racing / Redc 31st Jul : 6f Hcap | 31-Jul-13 17:35 | -6 | 3 | ||

| Horse Racing / Perth 31st Jul : 3m Hcap Chs | 31-Jul-13 17:10 | -2 | 1 | ||

| Horse Racing / Redc 31st Jul : 6f Hcap | 31-Jul-13 17:00 | -4 | 2 | ||

| Horse Racing / Good 31st Jul : 1m1f Hcap | 31-Jul-13 16:50 | -2 | 1 | ||

| Horse Racing / Perth 31st Jul : 2m4f Hcap Chs | 31-Jul-13 16:35 | -2 | 1 | ||

| Horse Racing / Redc 31st Jul : 1m2f Hcap | 31-Jul-13 15:50 | 7.4 | 2 | Morocco | 5.92 |

| Horse Racing / Perth 30th Jul : 2m Hcap Hrd | 30-Jul-13 18:30 | 3.8 | 1 | Cadore | 3 |

| Horse Racing / Bev 30th Jul : 1m2f Hcap | 30-Jul-13 17:45 | 10.5 | 2 | Hernando Torres | 7.56 |

| Horse Racing / Uttox 29th Jul : 3m Hcap Hrd | 29-Jul-13 19:50 | -2 | 1 | ||

| Horse Racing / Wind 29th Jul : 1m Hcap | 29-Jul-13 19:00 | -4 | 2 | ||

| Horse Racing / Wolv 29th Jul : 6f Hcap | 29-Jul-13 17:45 | 13.6 | 3 | Burren View Lady | 12.14 |

| Horse Racing / Wolv 29th Jul : 5f Mdn Stks | 29-Jul-13 17:15 | -2 | 1 | ||

| Horse Racing / Ayr 29th Jul : 1m Hcap | 29-Jul-13 17:00 | -2 | 1 | ||

| Horse Racing / Wolv 29th Jul : 1m6f Hcap | 29-Jul-13 16:45 | -6 | 3 | ||

| Horse Racing / Ayr 29th Jul : 1m Hcap | 29-Jul-13 16:30 | 7.8 | 1 | Le Chat Dor | 5.1 |

| Horse Racing / Wolv 29th Jul : 6f Hcap | 29-Jul-13 16:15 | 13.3 | 4 | Fathsta (2 pts) | 5.9 |

| Horse Racing / Ayr 29th Jul : 1m1f Hcap | 29-Jul-13 16:00 | 6.6 | 1 | Save The Bees | 4.51 |

| Horse Racing / Wolv 29th Jul : 6f Hcap | 29-Jul-13 15:45 | 12.7 | 5 | Reginald Claude (3 pts) | 3.9 |

| Horse Racing / Ayr 29th Jul : 7f Hcap | 29-Jul-13 15:30 | -2 | 1 | ||

| Horse Racing / Wolv 29th Jul : 1m4f Hcap | 29-Jul-13 15:15 | -4 | 2 | ||

| Horse Racing / Ayr 29th Jul : 1m5f Hcap | 29-Jul-13 15:00 | 1.9 | 2 | Beat The Tide | 2.98 |

| Horse Racing / Wolv 29th Jul : 7f Hcap | 29-Jul-13 14:45 | -2 | 1 | ||

| Horse Racing / Ayr 29th Jul : 5f Hcap | 29-Jul-13 14:30 | -4 | 2 | ||

| Horse Racing / Ponte 28th Jul : 5f Hcap | 28-Jul-13 17:40 | -2 | 1 | ||

| Horse Racing / Carl 28th Jul : 7f Hcap | 28-Jul-13 17:30 | -2 | 1 | ||

| Horse Racing / Carl 28th Jul : 1m1f Hcap | 28-Jul-13 17:00 | -2 | 1 | ||

| Horse Racing / Ponte 28th Jul : 1m Listed | 28-Jul-13 16:05 | -2 | 1 | ||

| Horse Racing / Ponte 28th Jul : 1m4f Hcap | 28-Jul-13 14:55 | -2 | 1 | ||

| Horse Racing / Chep 26th Jul : 5f Hcap | 26-Jul-13 19:50 | -2 | 1 | ||

| Horse Racing / Chep 26th Jul : 1m Hcap | 26-Jul-13 19:20 | 3.7 | 2 | Mandy The Nag | 3.95 |

| Horse Racing / Newm 26th Jul : 1m Hcap | 26-Jul-13 19:10 | 15.8 | 2 | On My Own | 10.31 |

| Horse Racing / Chep 26th Jul : 7f Hcap | 26-Jul-13 18:20 | -2 | 1 | ||

| Horse Racing / Thirsk 26th Jul : 5f Hcap | 26-Jul-13 17:25 | 5.9 | 1 | Oil Strike | 4.09 |

| Horse Racing / Uttox 26th Jul : 2m4f Hcap Hrd | 26-Jul-13 17:15 | 12.3 | 2 | Della Sun | 8.44 |

| Horse Racing / Thirsk 26th Jul : 6f Hcap | 26-Jul-13 17:00 | -2 | 1 | ||

| Horse Racing / Uttox 26th Jul : 3m Hcap Hrd | 26-Jul-13 16:05 | -2 | 1 | ||

| Horse Racing / Uttox 26th Jul : 2m Hcap Hrd | 26-Jul-13 15:30 | -2 | 1 | ||

| Horse Racing / Thirsk 26th Jul : 5f Mdn Stks | 26-Jul-13 15:20 | -2 | 1 | ||

| Horse Racing / Thirsk 26th Jul : 7f Mdn Stks | 26-Jul-13 14:45 | -2 | 1 | ||

| Horse Racing / Thirsk 26th Jul : 7f Hcap | 26-Jul-13 14:10 | -4 | 2 | ||

| Horse Racing / Leic 24th Jul : 1m2f Hcap | 24-Jul-13 20:50 | 3.9 | 1 | Dame Nellie Melba | 3.05 |

| Horse Racing / Sand 24th Jul : 1m Hcap | 24-Jul-13 20:05 | -2 | 1 | ||

| Horse Racing / Worc 24th Jul : 2m4f Hcap Hrd | 24-Jul-13 17:55 | -4 | 2 | ||

| Horse Racing / Leic 24th Jul : 7f Hcap | 24-Jul-13 17:40 | -4 | 2 | ||

| Horse Racing / Ling 24th Jul : 7f Hcap | 24-Jul-13 17:35 | 7.9 | 2 | Menelik | 6.16 |

| Horse Racing / Worc 24th Jul : 2m4f Hcap Hrd | 24-Jul-13 17:20 | 5.8 | 1 | Jigsaw Financial | 4.07 |

| Horse Racing / Ling 24th Jul : 6f Hcap | 24-Jul-13 17:10 | -6 | 3 | ||

| Horse Racing / Catt 24th Jul : 1m4f Hcap | 24-Jul-13 17:00 | -2 | 1 | ||

| Horse Racing / Ling 24th Jul : 5f Hcap | 24-Jul-13 16:40 | -1.2 | 2 | Dangerous Age | 2.4 |

| Horse Racing / Catt 24th Jul : 6f Hcap | 24-Jul-13 16:30 | -2 | 1 | ||

| Horse Racing / Ling 24th Jul : 1m4f Hcap | 24-Jul-13 16:10 | -6 | 3 | ||

| Horse Racing / Ling 24th Jul : 1m4f Mdn Stks | 24-Jul-13 15:40 | 1.8 | 2 | Fledged | 2.97 |

| Horse Racing / Worc 24th Jul : 2m7f Hcap Hrd | 24-Jul-13 15:20 | 4.5 | 1 | Sovereign Spirit | 3.34 |

| Horse Racing / Catt 24th Jul : 7f Nursery | 24-Jul-13 15:00 | -2 | 1 | ||

| Horse Racing / Worc 24th Jul : 2m4f Hcap Chs | 24-Jul-13 14:50 | -2 | 1 | ||

| Horse Racing / Worc 24th Jul : 2m7f Hcap Chs | 24-Jul-13 14:20 | -2 | 1 | ||

| Horse Racing / FfosL 23rd Jul : 5f Hcap | 23-Jul-13 21:05 | -4 | 2 | ||

| Horse Racing / Bang 23rd Jul : 2m4f Hcap Hrd | 23-Jul-13 20:45 | -2 | 1 | ||

| Horse Racing / Bang 23rd Jul : 2m1f Hcap Chs | 23-Jul-13 20:15 | -2 | 1 | ||

| Horse Racing / FfosL 23rd Jul : 1m4f Hcap | 23-Jul-13 19:35 | -2 | 1 | ||

| Horse Racing / Bang 23rd Jul : 3m Hcap Hrd | 23-Jul-13 19:15 | -2 | 1 | ||

| Horse Racing / FfosL 23rd Jul : 1m2f Hcap | 23-Jul-13 19:05 | 4.7 | 2 | Golden Jubilee | 4.5 |

| Horse Racing / Wind 22nd Jul : 1m2f Hcap | 22-Jul-13 19:20 | -2 | 1 | ||

| Horse Racing / Bev 22nd Jul : 1m2f Hcap | 22-Jul-13 19:00 | 7.7 | 1 | Maybeme | 5.03 |

| Horse Racing / Cart 22nd Jul : 2m1f Hcap Hrd | 22-Jul-13 17:30 | 11 | 1 | Lodgician | 6.8 |

| Horse Racing / Cart 22nd Jul : 2m1f Hcap Chs | 22-Jul-13 15:55 | -4 | 2 | ||

| Horse Racing / Cart 22nd Jul : 2m6f Hcap Hrd | 22-Jul-13 14:45 | -6 | 3 | ||

| Horse Racing / Ayr 22nd Jul : 7f Hcap | 22-Jul-13 14:30 | -2 | 1 | ||

| Horse Racing / Redc 21st Jul : 1m6f Hcap | 21-Jul-13 17:40 | 4.7 | 2 | Madrasa | 3.47 |

| Horse Racing / Newt 21st Jul : 3m2f Hcap Chs | 21-Jul-13 16:20 | -2 | 1 | ||

| Horse Racing / Ham 19th Jul : 1m1f Hcap | 19-Jul-13 21:15 | 4.9 | 1 | Wellingrove | 3.6 |

| Horse Racing / Ponte 19th Jul : 6f Hcap | 19-Jul-13 21:05 | -4 | 2 | ||

| Horse Racing / Ham 19th Jul : 1m3f Hcap | 19-Jul-13 20:45 | -4 | 2 | ||

| Horse Racing / Ponte 19th Jul : 1m2f Hcap | 19-Jul-13 20:35 | 5.5 | 2 | Arlecchino | 4.9 |

| Horse Racing / Nott 19th Jul : 1m Hcap | 19-Jul-13 17:50 | -2 | 1 | ||

| Horse Racing / Newb 19th Jul : 1m3f Hcap | 19-Jul-13 17:10 | -4 | 2 | ||

| Horse Racing / Brig 18th Jul : 5f Hcap | 18-Jul-13 16:50 | 5.3 | 1 | Excellent Aim | 3.79 |

| Horse Racing / Ham 18th Jul : 1m5f Hcap | 18-Jul-13 16:00 | -2 | 1 | ||

| Horse Racing / Leic 18th Jul : 7f Hcap | 18-Jul-13 15:40 | 6.1 | 1 | Ghasabah | 4.2 |

| Horse Racing / Ham 18th Jul : 1m1f Hcap | 18-Jul-13 15:30 | -2 | 1 | ||

| Horse Racing / Brig 18th Jul : 7f Hcap | 18-Jul-13 15:20 | -2 | 1 | ||

| Horse Racing / Sand 17th Jul : 7f Mdn Stks | 17-Jul-13 19:10 | -2 | 1 | ||

| Horse Racing / Ling 17th Jul : 1m2f Hcap | 17-Jul-13 17:30 | 4 | 4 | Precision Five | 6.1 |

| Horse Racing / Ling 17th Jul : 6f Hcap | 17-Jul-13 17:00 | 11.4 | 3 | Perfect Venture | 9 |

| Horse Racing / Catt 17th Jul : 1m4f Hcap | 17-Jul-13 16:40 | -2 | 1 | ||

| Horse Racing / Ling 17th Jul : 6f Mdn Stks | 17-Jul-13 16:30 | -6 | 3 | ||

| Horse Racing / Ling 17th Jul : 6f Mdn Stks | 17-Jul-13 16:00 | 2.1 | 1 | Along Again | 2.12 |

| Horse Racing / Uttox 17th Jul : 3m Hcap Chs | 17-Jul-13 15:50 | -2 | 1 | ||

| Horse Racing / Ling 17th Jul : 2m Hcap | 17-Jul-13 15:00 | -2 | 1 | ||

| Horse Racing / Yarm 16th Jul : 6f Hcap | 16-Jul-13 18:50 | -2 | 1 | ||

| Horse Racing / Kemp 16th Jul : 2m Hcap | 16-Jul-13 18:30 | -4 | 2 | ||

| Horse Racing / Kemp 16th Jul : 6f Mdn Stks | 16-Jul-13 18:00 | -2 | 1 | ||

| Horse Racing / Bev 16th Jul : 5f Hcap | 16-Jul-13 17:35 | -2 | 1 | ||

| Horse Racing / Bath 16th Jul : 5f Hcap | 16-Jul-13 17:15 | 2.1 | 2 | Dreams Of Glory | 3.12 |

| Horse Racing / Bev 16th Jul : 1m2f Hcap | 16-Jul-13 17:00 | 12.5 | 1 | City Ground | 7.6 |

| Horse Racing / Bath 16th Jul : 6f Hcap | 16-Jul-13 16:45 | 4.5 | 1 | Ginzan | 3.35 |

| Horse Racing / Bev 16th Jul : 7f Hcap | 16-Jul-13 16:30 | -2 | 1 | ||

| Horse Racing / Bev 16th Jul : 1m2f Hcap | 16-Jul-13 16:00 | -2 | 1 | ||

| Horse Racing / Bev 16th Jul : 5f Hcap | 16-Jul-13 14:30 | -2 | 1 | ||

| Horse Racing / Wolv 15th Jul : 1m Hcap | 15-Jul-13 21:20 | -4 | 2 | ||

| Horse Racing / Wolv 15th Jul : 7f Hcap | 15-Jul-13 19:50 | -1.8 | 4 | Future Reference | 3.1 |

| Horse Racing / Wind 15th Jul : 6f Mdn Stks | 15-Jul-13 19:30 | -2 | 1 | ||

| Horse Racing / Wind 15th Jul : 5f Mdn Stks | 15-Jul-13 19:00 | -2 | 1 | ||

| Horse Racing / Wolv 15th Jul : 1m6f Hcap | 15-Jul-13 18:50 | -2 | 1 | ||

| Horse Racing / Wolv 15th Jul : 6f Mdn Stks | 15-Jul-13 18:20 | -4 | 2 | ||

| Horse Racing / Wind 15th Jul : 5f Hcap | 15-Jul-13 18:00 | -4 | 2 | ||

| Horse Racing / Ayr 15th Jul : 1m5f Hcap | 15-Jul-13 17:30 | -2 | 1 | ||

| Horse Racing / Ayr 15th Jul : 1m Hcap | 15-Jul-13 16:30 | -2 | 1 | ||

| Horse Racing / Newt 15th Jul : 3m3f Hcap Hrd | 15-Jul-13 16:15 | -4 | 2 | ||

| Horse Racing / Newt 15th Jul : 2m6f Hcap Hrd | 15-Jul-13 15:45 | -4 | 2 | ||

| profit | -5.5 | ||||

| no. of bets | 246 | ||||

| winning bets | 48 | ||||

| strike rate | 20% |

Update: 12th October 2013

It’s been a couple of months since I wrote my last report on our BetHawk trial.

I have my reasons: hospital, holiday, life, stuff.

But the weird thing is, BetHawk doesn’t care. It just ploughs on regardless….

In fact, recent events may be the very best argument there is for getting this product. It does its thing and you forget about it.

So much so that I do often forget to run it! Which naturally doesn’t help.

However, every now and again, I remember to fire it up, and off it toddles, speculating with my money whilst I try my level best not to look.

So… how has BetHawk been doing?

Well, thanks for asking, pretty well in fact.

We are not really on speaking terms – BetHawk does its thing and I do mine – and of course it knows I don’t really trust betting bots.

But somehow, somewhere along the way, it decided to forgive me and start amassing profit.

And it has done this, courtesy of some new (ahem!) “dynamic portfolio config files”.

So now you know.

OK – so what do the numbers look like then?

In my first report, I managed to lose 5.5 points in 246 bets.

Not a disaster by any means, but hardly a pulse-quickening start either.

However, this time, thanks to my new impressively dynamic portfolio thingummy, we have recovered dramatically.

Look at this!

| bets | 291 |

| winners | 37 |

| strike rate | 13% |

| profit this time | 66.5 |

| points this time | 33.25 |

At this point in a review, I usually like to add lots of reflections about the way a service is designed, what it’s like to live with, what the risk profile is like, and any tips or tricks I’ve picked up along the way.

You know the score by now. 🙂

But frankly, with BetHawk there’s nothing to add.

Who the hell knows what it’s doing?!

OK OK there are a couple of things I suppose…

Firstly, the strike rate alarms me a bit (another reason not to look!).

And secondly, the way it often places multiple bets on the same race (and indeed, even on the same horse) adds to my general sense of bafflement.

But other than that, like I say, BetHawk goes its way, and I go mine.

Bottom line: BetHawk has made me 27.75 points after 537 bets. So really, who cares?

So should I just wind up the trial there, and award a Pass?

After all, I said last time that I might finish at 500 bets… which we long since passed.

But there’s just one thing though: that 13% strike rate really does make me nervous.

So: I’m going to let it run to at least 1000 bets.

Which probably means I’ll be back with my next update in December.

Provided that is, I remember to switch it on.

The complete results log for BetHawk this time was as follows…

| Market | Start time | ||||

| race profit | race bets | winning bets | win price | ||

| Horse Racing / Hex 12th Oct : 3m Hcap Hrd | 12-Oct-13 16:30 | -10 | 5 | ||

| Horse Racing / Newm 12th Oct : 7f Grp2 | 12-Oct-13 16:25 | -2 | 1 | ||

| Horse Racing / Chep 12th Oct : 2m3f Nov Chs | 12-Oct-13 16:15 | -4 | 2 | ||

| Horse Racing / Hex 12th Oct : 3m Hcap Hrd | 12-Oct-13 16:00 | -8 | 4 | ||

| Horse Racing / Chep 12th Oct : 2m4f Nov Hrd | 12-Oct-13 15:35 | -2 | 1 | ||

| Horse Racing / Hex 12th Oct : 2m4f Hcap Chs | 12-Oct-13 15:20 | 26.6 | 2 | Rossinis Dancer | 16 |

| Horse Racing / Chep 12th Oct : 2m4f Nov Hrd | 12-Oct-13 15:00 | -2 | 1 | ||

| Horse Racing / York 12th Oct : 6f Listed | 12-Oct-13 14:55 | -2 | 1 | ||

| Horse Racing / Wolv 11th Oct : 1m1f Hcap | 11-Oct-13 21:10 | -6 | 3 | ||

| Horse Racing / Wolv 11th Oct : 1m Nursery | 11-Oct-13 20:40 | 7.5 | 4 | Earthflight | 8.95 |

| Horse Racing / Wolv 11th Oct : 1m Mdn Stks | 11-Oct-13 20:10 | 9.9 | 2 | Miguel Grau x2 | 3.58 |

| Horse Racing / Wolv 11th Oct : 1m6f Hcap | 11-Oct-13 19:40 | 5.5 | 7 | Getaway Car x3 | 3.31 |

| Horse Racing / Wolv 11th Oct : 6f Hcap | 11-Oct-13 19:10 | -6 | 3 | ||

| Horse Racing / Wolv 11th Oct : 6f Hcap | 11-Oct-13 18:40 | 2.5 | 6 | Fat Gary x2 | 3.63 |

| Horse Racing / Wolv 11th Oct : 7f Hcap | 11-Oct-13 18:10 | -2 | 1 | ||

| Horse Racing / Wolv 11th Oct : 7f Mdn Stks | 11-Oct-13 17:40 | -2 | 1 | ||

| Horse Racing / Newt 11th Oct : 2m1f NHF | 11-Oct-13 17:10 | -2 | 1 | ||

| Horse Racing / Carl 11th Oct : 2m1f Hcap Hrd | 11-Oct-13 14:10 | 7.6 | 5 | Tweedo Paradiso x2 | 4.5 |

| Horse Racing / York 11th Oct : 6f Nursery | 11-Oct-13 14:00 | 18.9 | 0 | Aeolus | 10.97 |

| Horse Racing / Newt 11th Oct : 2m1f Juv Hrd | 11-Oct-13 13:50 | -2 | 1 | ||

| Horse Racing / Wolv 7th Oct : 1m Hcap | 07-Oct-13 17:30 | -4 | 2 | ||

| Horse Racing / Wind 7th Oct : 1m Hcap | 07-Oct-13 17:20 | -2 | 1 | ||

| Horse Racing / Ponte 7th Oct : 1m Mdn Stks | 07-Oct-13 17:10 | -2 | 1 | ||

| Horse Racing / Wolv 7th Oct : 1m4f Hcap | 07-Oct-13 17:00 | -4 | 2 | ||

| Horse Racing / Ponte 7th Oct : 1m4f Hcap | 07-Oct-13 16:40 | -6 | 3 | ||

| Horse Racing / Wolv 7th Oct : 6f Hcap | 07-Oct-13 16:30 | -2 | 1 | ||

| Horse Racing / Wolv 7th Oct : 6f Hcap | 07-Oct-13 16:00 | 10.3 | 3 | French Press | 8.4 |

| Horse Racing / Wind 7th Oct : 1m3f Hcap | 07-Oct-13 15:50 | -2 | 1 | ||

| Horse Racing / Wolv 7th Oct : 6f Mdn Stks | 07-Oct-13 15:30 | -4 | 2 | ||

| Horse Racing / Wind 7th Oct : 1m Mdn Stks | 07-Oct-13 14:50 | -2 | 1 | ||

| Horse Racing / Ponte 7th Oct : 6f Nursery | 07-Oct-13 14:40 | -2 | 1 | ||

| Horse Racing / Wolv 7th Oct : 7f Hcap | 07-Oct-13 14:30 | -2 | 1 | ||

| Horse Racing / Wind 7th Oct : 1m Mdn Stks | 07-Oct-13 14:20 | -2 | 1 | ||

| Horse Racing / Kelso 6th Oct : 2m NHF | 06-Oct-13 17:45 | -2 | 1 | ||

| Horse Racing / Kelso 6th Oct : 2m2f Hcap Hrd | 06-Oct-13 17:15 | -4 | 2 | ||

| Horse Racing / Uttox 6th Oct : 2m Hcap Hrd | 06-Oct-13 17:05 | -4 | 2 | ||

| Horse Racing / Hunt 6th Oct : 3m2f Hcap Hrd | 06-Oct-13 16:55 | -2 | 1 | ||

| Horse Racing / Kelso 6th Oct : 2m2f Hcap Hrd | 06-Oct-13 16:45 | -2 | 1 | ||

| Horse Racing / Uttox 6th Oct : 3m Hcap Chs | 06-Oct-13 16:35 | 11.8 | 2 | Roc de Guye | 8.2 |

| Horse Racing / Hunt 6th Oct : 2m4f Hcap Hrd | 06-Oct-13 16:25 | -8 | 4 | ||

| Horse Racing / Kelso 6th Oct : 2m7f Hcap Chs | 06-Oct-13 16:15 | 4.1 | 2 | Chicago Outfit | 4.13 |

| Horse Racing / Uttox 6th Oct : 3m Hcap Hrd | 06-Oct-13 16:05 | -4 | 2 | ||

| Horse Racing / Hunt 6th Oct : 2m Juv Hrd | 06-Oct-13 15:25 | -2 | 1 | ||

| Horse Racing / Hunt 6th Oct : 2m Hcap Chs | 06-Oct-13 14:45 | -2 | 1 | ||

| Horse Racing / Kelso 6th Oct : 2m Juv Hrd | 06-Oct-13 14:35 | -2 | 1 | ||

| Horse Racing / Hunt 6th Oct : 2m Nov Hrd | 06-Oct-13 14:10 | -2 | 1 | ||

| Horse Racing / Kelso 6th Oct : 2m Hcap Hrd | 06-Oct-13 14:00 | -4 | 2 | ||

| Horse Racing / Wolv 5th Oct : 1m Hcap | 05-Oct-13 21:15 | -2 | 1 | ||

| Horse Racing / Wolv 5th Oct : 1m1f Hcap | 05-Oct-13 19:30 | -2 | 1 | ||

| Horse Racing / Wolv 5th Oct : 1m1f Hcap | 05-Oct-13 19:00 | -4 | 2 | ||

| Horse Racing / Wolv 5th Oct : 1m4f Hcap | 05-Oct-13 18:30 | -4 | 2 | ||

| Horse Racing / Redc 5th Oct : 5f Hcap | 05-Oct-13 17:35 | 1 | 3 | Thatcherite | 3.55 |

| Horse Racing / Redc 5th Oct : 5f Hcap | 05-Oct-13 17:05 | -4 | 2 | ||

| Horse Racing / Font 5th Oct : 2m6f Hcap Chs | 05-Oct-13 16:50 | -2 | 1 | ||

| Horse Racing / Newm 5th Oct : 6f Listed | 05-Oct-13 16:45 | -2 | 1 | ||

| Horse Racing / Redc 5th Oct : 1m2f Hcap | 05-Oct-13 16:35 | -2 | 1 | ||

| Horse Racing / Ascot 5th Oct : 7f Listed | 05-Oct-13 16:25 | -2 | 1 | ||

| Horse Racing / Font 5th Oct : 3m3f Hcap Hrd | 05-Oct-13 16:15 | -4 | 2 | ||

| Horse Racing / Newm 5th Oct : 1m2f Listed | 05-Oct-13 16:10 | -2 | 1 | ||

| Horse Racing / Redc 5th Oct : 1m2f Sell Stks | 05-Oct-13 16:00 | -2 | 1 | ||

| Horse Racing / Ascot 5th Oct : 7f Hcap | 05-Oct-13 15:50 | -2 | 1 | ||

| Horse Racing / Newm 5th Oct : 1m Mdn Stks | 05-Oct-13 15:35 | -2 | 1 | ||

| Horse Racing / Ascot 5th Oct : 6f Grp3 | 05-Oct-13 15:15 | 21.8 | 1 | Tropics | 12.43 |

| Horse Racing / Redc 5th Oct : 7f Listed | 05-Oct-13 14:50 | -2 | 1 | ||

| Horse Racing / Newm 5th Oct : 7f Stks | 05-Oct-13 14:20 | -2 | 1 | ||

| Horse Racing / Redc 5th Oct : 1m Hcap | 05-Oct-13 14:15 | -2 | 1 | ||

| Horse Racing / Ascot 5th Oct : 5f Grp3 | 05-Oct-13 14:05 | -2 | 1 | ||

| Horse Racing / Newm 5th Oct : 7f Stks | 05-Oct-13 13:50 | -2 | 1 | ||

| Horse Racing / Redc 5th Oct : 7f Mdn Stks | 05-Oct-13 13:40 | -2 | 1 | ||

| Horse Racing / Ascot 5th Oct : 5f Listed | 05-Oct-13 13:30 | -2 | 1 | ||

| Horse Racing / Wolv 4th Oct : 1m1f Hcap | 04-Oct-13 20:55 | -2 | 1 | ||

| Horse Racing / Wolv 4th Oct : 1m Mdn Stks | 04-Oct-13 20:25 | -2 | 1 | ||

| Horse Racing / Wolv 4th Oct : 1m4f Mdn Stks | 04-Oct-13 19:25 | -2 | 1 | ||

| Horse Racing / Wolv 4th Oct : 1m6f Hcap | 04-Oct-13 18:55 | -4 | 2 | ||

| Horse Racing / Wolv 4th Oct : 6f Claim Stks | 04-Oct-13 18:25 | -2 | 1 | ||

| Horse Racing / Font 4th Oct : 2m2f Hcap Hrd | 04-Oct-13 15:15 | -2 | 1 | ||

| Horse Racing / Ascot 4th Oct : 6f Hcap | 04-Oct-13 15:05 | -2 | 1 | ||

| Horse Racing / Ascot 4th Oct : 1m Stks | 04-Oct-13 14:30 | -2 | 1 | ||

| Horse Racing / Font 4th Oct : 2m2f Mdn Hrd | 04-Oct-13 14:10 | 49.6 | 2 | Hallings Wish x 2 | 14.04 |

| Horse Racing / Ascot 4th Oct : 7f Hcap | 04-Oct-13 14:00 | -2 | 1 | ||

| Horse Racing / Wolv 3rd Oct : 1m Hcap | 03-Oct-13 20:40 | 7.6 | 2 | Let Me In | 6 |

| Horse Racing / Wolv 3rd Oct : 1m4f Claim Stks | 03-Oct-13 20:10 | -2 | 1 | ||

| Horse Racing / Wolv 3rd Oct : 7f Sell Stks | 03-Oct-13 19:40 | -2 | 1 | ||

| Horse Racing / Wolv 3rd Oct : 6f Hcap | 03-Oct-13 19:10 | -6 | 3 | ||

| Horse Racing / Wolv 3rd Oct : 6f Mdn Stks | 03-Oct-13 18:40 | 1.4 | 1 | Miss Atomic Bomb | 1.74 |

| Horse Racing / Wolv 3rd Oct : 6f Hcap | 03-Oct-13 18:10 | -6 | 3 | ||

| Horse Racing / Warw 3rd Oct : 1m7f Hcap | 03-Oct-13 17:45 | -2 | 1 | ||

| Horse Racing / Wolv 3rd Oct : 6f Nursery | 03-Oct-13 17:40 | 6.9 | 3 | Shyron | 6.65 |

| Horse Racing / Sthl 3rd Oct : 1m Hcap | 03-Oct-13 17:30 | 19.3 | 3 | Greyfriarschorista | 13.16 |

| Horse Racing / Warw 3rd Oct : 6f Hcap | 03-Oct-13 17:10 | -2 | 1 | ||

| Horse Racing / Sthl 3rd Oct : 6f Hcap | 03-Oct-13 17:00 | 15.2 | 3 | King Bertie x 2 | 5.51 |

| Horse Racing / Warw 3rd Oct : 1m3f Hcap | 03-Oct-13 16:40 | -2 | 1 | ||

| Horse Racing / Newc 2nd Oct : 7f Hcap | 02-Oct-13 15:45 | -2 | 1 | ||

| Horse Racing / Nott 2nd Oct : 1m Mdn Stks | 02-Oct-13 15:35 | 38.4 | 1 | Cambridge | 21.2 |

| Horse Racing / Nott 2nd Oct : 5f Hcap | 02-Oct-13 15:00 | -4 | 2 | ||

| Horse Racing / Newc 2nd Oct : 7f Mdn Stks | 02-Oct-13 14:40 | -2 | 1 | ||

| Horse Racing / Nott 2nd Oct : 5f Mdn Stks | 02-Oct-13 14:30 | -2 | 1 | ||

| Horse Racing / Salis 2nd Oct : 1m Mdn Stks | 02-Oct-13 14:20 | -2 | 1 | ||

| Horse Racing / Newc 2nd Oct : 1m Mdn Stks | 02-Oct-13 14:10 | -2 | 1 | ||

| Horse Racing / Nott 2nd Oct : 1m2f Nursery | 02-Oct-13 14:00 | 4.5 | 1 | Fair Flutter | 3.36 |

| Horse Racing / Salis 2nd Oct : 1m Mdn Stks | 02-Oct-13 13:45 | -2 | 1 | ||

| Horse Racing / Kemp 1st Oct : 6f Hcap | 01-Oct-13 21:20 | -2 | 1 | ||

| Horse Racing / Kemp 1st Oct : 6f Hcap | 01-Oct-13 20:50 | -4 | 2 | ||

| Horse Racing / Kemp 1st Oct : 1m3f Hcap | 01-Oct-13 20:20 | -2 | 1 | ||

| Horse Racing / Kemp 1st Oct : 1m3f Mdn Stks | 01-Oct-13 19:50 | -4 | 2 | ||

| Horse Racing / Kemp 1st Oct : 1m Hcap | 01-Oct-13 19:20 | -2 | 1 | ||

| Horse Racing / Kemp 1st Oct : 1m Nursery | 01-Oct-13 18:50 | -6 | 3 | ||

| Horse Racing / Ayr 1st Oct : 5f Hcap | 01-Oct-13 17:30 | -2 | 1 | ||

| Horse Racing / Chep 1st Oct : 2m Hcap Hrd | 01-Oct-13 16:50 | -2 | 1 | ||

| Horse Racing / Chep 1st Oct : 2m Hcap Chs | 01-Oct-13 16:15 | -2 | 1 | ||

| Horse Racing / Ayr 1st Oct : 7f Hcap | 01-Oct-13 17:00 | 12.9 | 1 | Deliberation | 7.8 |

| Horse Racing / Sedge 1st Oct : 2m4f Hcap Hrd | 01-Oct-13 16:35 | -2 | 1 | ||

| Horse Racing / Ayr 1st Oct : 7f Hcap | 01-Oct-13 16:25 | 12.9 | 1 | Natures Law | 7.8 |

| Horse Racing / Ayr 1st Oct : 1m5f Hcap | 01-Oct-13 15:50 | -2 | 1 | ||

| Horse Racing / Sedge 1st Oct : 2m4f Hcap Chs | 01-Oct-13 15:25 | -2 | 1 | ||

| Horse Racing / Ayr 1st Oct : 6f Hcap | 01-Oct-13 15:15 | -4 | 2 | ||

| Horse Racing / Chep 1st Oct : 3m Hcap Hrd | 01-Oct-13 14:30 | -4 | 2 | ||

| Horse Racing / Sedge 1st Oct : 2m1f Nov Hrd | 01-Oct-13 14:20 | -2 | 1 | ||

| Horse Racing / Muss 29th Sep : 5f Hcap | 29-Sep-13 17:45 | -2 | 1 | ||

| Horse Racing / Epsm 29th Sep : 7f Hcap | 29-Sep-13 17:30 | -2 | 1 | ||

| Horse Racing / Muss 29th Sep : 5f Hcap | 29-Sep-13 17:15 | -2 | 1 | ||

| Horse Racing / Muss 29th Sep : 1m1f Hcap | 29-Sep-13 16:45 | -2 | 1 | ||

| Horse Racing / Wolv 28th Sep : 7f Hcap | 28-Sep-13 21:00 | -4 | 2 | ||

| Horse Racing / Wolv 28th Sep : 7f Hcap | 28-Sep-13 20:30 | -2 | 1 | ||

| Horse Racing / Wolv 28th Sep : 5f Hcap | 28-Sep-13 20:00 | -2 | 1 | ||

| Horse Racing / Wolv 28th Sep : 1m Nursery | 28-Sep-13 19:00 | 0.5 | 3 | Top Dollar | 3.26 |

| Horse Racing / Wolv 28th Sep : 1m1f Hcap | 28-Sep-13 18:30 | 2.4 | 2 | Goal | 3.27 |

| Horse Racing / Wolv 28th Sep : 5f Claim Stks | 28-Sep-13 18:00 | -2 | 1 | ||

| Horse Racing / Ripon 28th Sep : 5f Hcap | 28-Sep-13 17:25 | -2 | 1 | ||

| Horse Racing / Newm 28th Sep : 7f Hcap | 28-Sep-13 17:00 | -2 | 1 | ||

| Horse Racing / Ripon 28th Sep : 1m4f Mdn Stks | 28-Sep-13 16:55 | -2 | 1 | ||

| Horse Racing / Chest 28th Sep : 7f Hcap | 28-Sep-13 16:50 | -2 | 1 | ||

| Horse Racing / MrktR 28th Sep : 2m3f Hcap Hrd | 28-Sep-13 16:30 | -2 | 1 | ||

| Horse Racing / Newm 28th Sep : 7f Nursery | 28-Sep-13 16:25 | -2 | 1 | ||

| Horse Racing / Ripon 28th Sep : 1m4f Hcap | 28-Sep-13 16:20 | -2 | 1 | ||

| Horse Racing / Chest 28th Sep : 5f Nursery | 28-Sep-13 16:15 | -2 | 1 | ||

| Horse Racing / Hayd 28th Sep : 6f Hcap | 28-Sep-13 16:05 | -2 | 1 | ||

| Horse Racing / Ripon 28th Sep : 6f Hcap | 28-Sep-13 15:45 | -2 | 1 | ||

| Horse Racing / Hayd 28th Sep : 5f Hcap | 28-Sep-13 15:30 | -2 | 1 | ||

| Horse Racing / MrktR 28th Sep : 2m6f Hcap Chs | 28-Sep-13 15:20 | -4 | 2 | ||

| Horse Racing / Hayd 28th Sep : 1m Mdn Stks | 28-Sep-13 15:00 | 8.1 | 2 | Monsea | 6.26 |

| Horse Racing / MrktR 28th Sep : 2m6f Listed | 28-Sep-13 14:50 | -2 | 1 | ||

| Horse Racing / Chest 28th Sep : 6f Hcap | 28-Sep-13 14:30 | -2 | 1 | ||

| Horse Racing / Hayd 28th Sep : 1m Mdn Stks | 28-Sep-13 14:25 | 9.5 | 2 | Flippant | 7.01 |

| Horse Racing / MrktR 28th Sep : 2m1f Listed | 28-Sep-13 14:15 | 19.9 | 1 | Ahyaknowyerself | 11.5 |

| Horse Racing / Chest 28th Sep : 7f Mdn Stks | 28-Sep-13 13:55 | -2 | 1 | ||

| Horse Racing / MrktR 28th Sep : 2m1f Juv Hrd | 28-Sep-13 13:45 | -2 | 1 | ||

| Horse Racing / Wolv 27th Sep : 1m1f Hcap | 27-Sep-13 21:10 | 10.3 | 2 | Legends x2 | 3.68 |

| Horse Racing / Wolv 27th Sep : 1m6f Hcap | 27-Sep-13 20:40 | -4 | 2 | ||

| Horse Racing / Wolv 27th Sep : 7f Mdn Stks | 27-Sep-13 19:40 | -2 | 1 | ||

| Horse Racing / Worc 27th Sep : 2m7f Hcap Hrd | 27-Sep-13 17:45 | -6 | 3 | ||

| Horse Racing / Wolv 27th Sep : 1m Hcap | 27-Sep-13 17:40 | -6 | 3 | ||

| Horse Racing / Hayd 27th Sep : 1m2f Hcap | 27-Sep-13 17:20 | -4 | 2 | ||

| Horse Racing / Worc 27th Sep : 2m Hcap Hrd | 27-Sep-13 17:10 | -8 | 4 | ||

| Horse Racing / Worc 27th Sep : 2m7f Hcap Hrd | 27-Sep-13 16:35 | -4 | 2 | ||

| Horse Racing / Hayd 27th Sep : 1m Hcap | 27-Sep-13 16:10 | -2 | 1 | ||

| Horse Racing / Worc 27th Sep : 2m4f Mdn Hrd | 27-Sep-13 16:00 | -2 | 1 | ||

| Horse Racing / Newm 27th Sep : 7f Mdn Stks | 27-Sep-13 15:50 | -2 | 1 | ||

| Horse Racing / Hayd 27th Sep : 5f Nursery | 27-Sep-13 15:35 | -2 | 1 | ||

| Horse Racing / Hayd 27th Sep : 6f Mdn Stks | 27-Sep-13 15:00 | 33.2 | 1 | True Comment | 18.5 |

| Horse Racing / Hayd 27th Sep : 6f Mdn Stks | 27-Sep-13 14:30 | 40.3 | 1 | Dutch S | 22.22 |

| Horse Racing / Newm 27th Sep : 1m Listed | 27-Sep-13 14:10 | -2 | 1 | ||

| Horse Racing / Hayd 27th Sep : 1m4f Hcap | 27-Sep-13 14:00 | -2 | 1 | ||

| Horse Racing / Hayd 27th Sep : 1m4f Hcap | 27-Sep-13 13:30 | 4.8 | 2 | Mister Fizz | 4.54 |

| Horse Racing / Redc 25th Sep : 6f Hcap | 25-Sep-13 18:05 | -2 | 1 | ||

| Horse Racing / Kemp 25th Sep : 6f Mdn Stks | 25-Sep-13 17:55 | 1.9 | 1 | Mushir | 1.98 |

| Horse Racing / Perth 25th Sep : 3m Hcap Hrd | 25-Sep-13 17:40 | -2 | 1 | ||

| Horse Racing / Redc 25th Sep : 6f Hcap | 25-Sep-13 17:30 | -4 | 2 | ||

| Horse Racing / Kemp 25th Sep : 5f Mdn Stks | 25-Sep-13 17:25 | 7 | 1 | Dutch Interior | 4.7 |

| Horse Racing / Good 25th Sep : 5f Hcap | 25-Sep-13 17:20 | 8.7 | 2 | Threave | 6.58 |

| Horse Racing / Perth 25th Sep : 3m Hcap Chs | 25-Sep-13 17:10 | -2 | 1 | ||

| Horse Racing / Good 25th Sep : 6f Hcap | 25-Sep-13 16:50 | -2 | 1 | ||

| Horse Racing / Redc 25th Sep : 1m2f Hcap | 25-Sep-13 16:25 | -6 | 3 | ||

| Horse Racing / Good 25th Sep : 1m3f Hcap | 25-Sep-13 16:15 | -2 | 1 | ||

| Horse Racing / Redc 25th Sep : 5f Hcap | 25-Sep-13 15:50 | -2 | 1 | ||

| Horse Racing / Good 25th Sep : 1m2f Listed | 25-Sep-13 15:40 | -2 | 1 | ||

| Horse Racing / Redc 25th Sep : 1m Nursery | 25-Sep-13 14:40 | -4 | 2 | ||

| Horse Racing / Ham 23rd Sep : To Be Placed | 23-Sep-13 16:40 | 8 | 1 | Aramist | 1.42 |

| Horse Racing / Ayr 20th Sep : 1m Hcap | 20-Sep-13 17:10 | -2 | 1 | ||

| Horse Racing / Newb 20th Sep : 1m2f Hcap | 20-Sep-13 17:20 | 19.9 | 1 | Pasaka Boy | 11.5 |

| Horse Racing / Newb 20th Sep : 7f Listed | 20-Sep-13 16:50 | -2 | 1 | ||

| Horse Racing / Ayr 20th Sep : 1m Hcap | 20-Sep-13 16:35 | -4 | 2 | ||

| Horse Racing / Newc 20th Sep : 1m4f Hcap | 20-Sep-13 16:25 | -2 | 1 | ||

| Horse Racing / Newc 20th Sep : 1m2f Hcap | 20-Sep-13 15:15 | -2 | 1 | ||

| Horse Racing / Newc 20th Sep : 1m Hcap | 20-Sep-13 15:50 | -2 | 1 | ||

| Horse Racing / Ayr 20th Sep : 2m1f Hcap | 20-Sep-13 15:25 | -4 | 2 | ||

| Horse Racing / Kemp 18th Sep : 1m4f Hcap | 18-Sep-13 19:15 | 15.8 | 4 | Ebony Roc x2 | 6.16 |

| Horse Racing / Kemp 18th Sep : 1m2f Hcap | 18-Sep-13 18:45 | -2 | 1 | ||

| Horse Racing / Kemp 18th Sep : 1m2f Nursery | 18-Sep-13 18:15 | -2 | 1 |

Update: 29th November 2013

It’s been six weeks since my last pretty upbeat report on the BetHawk trial.

I do keep forgetting to run the thing(!), but I don’t suppose it matters that much. After all, I’ve still racked up 986 bets so far, which is starting to look like a pretty robust trial.

So, most importantly, are we still in the money?

In a word, No, but we’re only slightly overdrawn.

A total loss of 8.25 points after 986 bets isn’t a disaster by any means, nor indeed is it conclusive.

And so it’s very hard to know what to make of our progress. Because the thing is so opaque, I can barely comment on the way it works.

The bottom line is: almost 1000 bets have passed, and I still don’t know what to do with BetHawk.

So OK.. deep breath — this is what I’m going to do!

I do hereby solemnly swear to run BetHawk at least four days a week until Christmas.

With the express purpose of completing at least TWO THOUSAND BETS IN MY TRIAL.

Then I’m going to stop.

If it’s still 8 points or so down, it’s going in the Neutral folder.

But I do hope it goes one way or another, as level outcomes are such an anti-climax!

And of course, in spite of all my well-documented doubts about betting bots, I still have to admit that the basic idea is rather intoxicating.

The portfolio that runs itself!!

Who wouldn’t want it to work!?

Here are the top-level statistics.

In report #1, I managed to lose £5.50, or 2.75 points, in 246 bets.

In report #2, I added 33.25 points from 291 selections, to get me quite excited!

But unfortunately, this time, I’ve managed to lose 38.75 points in 449 bets, to leave me with a net balance of -8.25. 🙁

| Bets this time | 449 |

| Winners this time | 54 |

| Strike rate this time | 12.03% |

| Profit this time (£) | -77.5 |

| Profit this time (points) | -38.75 |

| Total bets so far | 986 |

| Total winners | 139 |

| Strike rate for trial | 14.10% |

| Total profit (£) | -16.5 |

| Total profit (points) | -8.25 |

The stand-out stat is, of course, that strike rate, which can translate into quite a few dispiriting runs. However, the thing about using a bot is – I barely look!

After all, what’s the point?

It’s not as if I can influence BetHawk, is it!?

The complete log of results for the last six weeks is as follows.

| Market | Start time | Bets this race | Profit/loss (GBP) |

| Horse Racing / Extr 24th Nov : 2m1f Hcap Hrd | 24-Nov-13 16:05 | 4 | 14.7 |

| Horse Racing / Towc 24th Nov : 2m NHF | 24-Nov-13 15:45 | 1 | -2 |

| Horse Racing / Extr 24th Nov : 2m1f Nov Hrd | 24-Nov-13 15:35 | 2 | -4 |

| Horse Racing / Towc 24th Nov : 2m6f Hcap Chs | 24-Nov-13 15:15 | 2 | -4 |

| Horse Racing / Extr 24th Nov : 2m1f Hcap Chs | 24-Nov-13 15:05 | 2 | -4 |

| Horse Racing / Towc 24th Nov : 2m5f Hcap Hrd | 24-Nov-13 14:45 | 2 | -4 |

| Horse Racing / Extr 24th Nov : 3m Hcap Chs | 24-Nov-13 14:35 | 4 | 13.3 |

| Horse Racing / Towc 24th Nov : 3m Hcap Chs | 24-Nov-13 14:15 | 4 | -8 |

| Horse Racing / Extr 24th Nov : 3m Hcap Chs | 24-Nov-13 14:05 | 2 | 8.7 |

| Horse Racing / Extr 24th Nov : 2m7f Hcap Hrd | 24-Nov-13 13:35 | 2 | -4 |

| Horse Racing / Towc 24th Nov : 2m3f Hcap Chs | 24-Nov-13 13:45 | 1 | 6.6 |

| Horse Racing / Towc 24th Nov : 2m Claim Hrd | 24-Nov-13 13:15 | 1 | -2 |

| Horse Racing / Towc 24th Nov : 2m5f Nov Hrd | 24-Nov-13 12:45 | 1 | -2 |

| Horse Racing / Extr 24th Nov : 2m1f Nov Hrd | 24-Nov-13 12:35 | 2 | -4 |

| Horse Racing / Wolv 23rd Nov : 6f Nursery | 23-Nov-13 17:50 | 2 | -4 |

| Horse Racing / Ascot 23rd Nov : 2m6f Hcap Hrd | 23-Nov-13 13:30 | 3 | 4.7 |

| Horse Racing / Ling 23rd Nov : 7f Hcap | 23-Nov-13 13:25 | 1 | 5 |

| Horse Racing / Hayd 23rd Nov : 3m5f Hcap Chs | 23-Nov-13 13:15 | 2 | -4 |

| Horse Racing / Hunt 23rd Nov : 2m Hcap Chs | 23-Nov-13 13:10 | 2 | 5.6 |

| Horse Racing / Ascot 23rd Nov : 3m Hcap Chs | 23-Nov-13 13:00 | 2 | 8.8 |

| Horse Racing / Ling 23rd Nov : 7f Cond Stks | 23-Nov-13 12:55 | 2 | -4 |

| Horse Racing / Hayd 23rd Nov : 2m Hrd | 23-Nov-13 12:45 | 1 | 5.9 |

| Horse Racing / Hunt 23rd Nov : 2m Hcap Hrd | 23-Nov-13 12:35 | 1 | -2 |

| Horse Racing / Ling 23rd Nov : 5f Mdn Stks | 23-Nov-13 12:20 | 2 | 6.6 |

| Horse Racing / Hayd 23rd Nov : 2m Hcap Hrd | 23-Nov-13 12:10 | 4 | -8 |

| Horse Racing / Wolv 22nd Nov : 1m6f Hcap | 22-Nov-13 17:10 | 6 | -12 |

| Horse Racing / Wolv 22nd Nov : 6f Mdn Stks | 22-Nov-13 16:40 | 1 | 2.1 |

| Horse Racing / Wolv 22nd Nov : 6f Hcap | 22-Nov-13 16:10 | 7 | 33.2 |

| Horse Racing / Ascot 22nd Nov : 2m Hcap Hrd | 22-Nov-13 15:50 | 2 | -4 |

| Horse Racing / FfosL 22nd Nov : 2m3f Hcap Chs | 22-Nov-13 15:25 | 1 | -2 |

| Horse Racing / Ascot 22nd Nov : 3m Hcap Chs | 22-Nov-13 15:15 | 3 | -6 |

| Horse Racing / Hayd 22nd Nov : 2m4f Nov Hrd | 22-Nov-13 15:05 | 1 | 8.6 |

| Horse Racing / FfosL 22nd Nov : 2m6f Hcap Hrd | 22-Nov-13 14:50 | 1 | -2 |

| Horse Racing / FfosL 22nd Nov : 2m5f Hcap Chs | 22-Nov-13 14:15 | 2 | -4 |

| Horse Racing / Hayd 22nd Nov : 2m Listed Hrd | 22-Nov-13 13:55 | 2 | 1.6 |

| Horse Racing / FfosL 22nd Nov : 3m Hcap Chs | 22-Nov-13 13:40 | 2 | -4 |

| Horse Racing / Ascot 22nd Nov : 2m3f Beg Chs | 22-Nov-13 13:30 | 1 | -2 |

| Horse Racing / Hayd 22nd Nov : 2m1f Grad Chs | 22-Nov-13 13:20 | 2 | -4 |

| Horse Racing / Ascot 22nd Nov : 2m3f Mdn Hrd | 22-Nov-13 13:00 | 1 | -2 |

| Horse Racing / Hayd 22nd Nov : 3m Hcap Hrd | 22-Nov-13 12:50 | 1 | -2 |

| Horse Racing / FfosL 22nd Nov : 2m4f Mdn Hrd | 22-Nov-13 12:40 | 1 | -2 |

| Horse Racing / Kemp 21st Nov : 7f Hcap | 21-Nov-13 19:40 | 4 | -8 |

| Horse Racing / Kemp 21st Nov : 7f Hcap | 21-Nov-13 19:10 | 3 | -6 |

| Horse Racing / Kemp 21st Nov : 1m3f Hcap | 21-Nov-13 18:40 | 2 | -4 |

| Horse Racing / Kemp 21st Nov : 1m Hcap | 21-Nov-13 18:10 | 3 | 11.7 |

| Horse Racing / Kemp 21st Nov : 1m Hcap | 21-Nov-13 17:40 | 4 | 2.1 |

| Horse Racing / Kemp 21st Nov : 6f Nursery | 21-Nov-13 16:40 | 4 | -8 |

| Horse Racing / Kemp 21st Nov : 6f Claim Stks | 21-Nov-13 16:10 | 2 | -4 |

| Horse Racing / Winc 21st Nov : 1m6f NHF | 21-Nov-13 16:00 | 1 | -2 |

| Horse Racing / Chep 21st Nov : 3m Hcap Hrd | 21-Nov-13 15:50 | 3 | -6 |

| Horse Racing / Winc 21st Nov : 2m5f Hcap Chs | 21-Nov-13 15:30 | 1 | -2 |

| Horse Racing / Chep 21st Nov : 3m Hcap Chs | 21-Nov-13 15:20 | 6 | -12 |

| Horse Racing / MrktR 21st Nov : 2m4f Hcap Chs | 21-Nov-13 15:10 | 2 | -4 |

| Horse Racing / Winc 21st Nov : 2m5f Hcap Chs | 21-Nov-13 15:00 | 1 | -2 |

| Horse Racing / Chep 21st Nov : 2m3f Hcap Chs | 21-Nov-13 14:50 | 4 | -1.4 |

| Horse Racing / MrktR 21st Nov : 2m5f Hcap Hrd | 21-Nov-13 14:40 | 2 | 3.2 |

| Horse Racing / Chep 21st Nov : 2m Hcap Hrd | 21-Nov-13 14:15 | 5 | -10 |

| Horse Racing / MrktR 21st Nov : 3m Hcap Hrd | 21-Nov-13 14:05 | 3 | 0.3 |

| Horse Racing / Winc 21st Nov : 2m4f Hcap Hrd | 21-Nov-13 13:50 | 2 | 6.8 |

| Horse Racing / MrktR 21st Nov : 2m6f Hcap Chs | 21-Nov-13 13:30 | 2 | -4 |

| Horse Racing / Winc 21st Nov : 2m Hcap Chs | 21-Nov-13 13:20 | 3 | -6 |

| Horse Racing / Chep 21st Nov : 2m Hcap Chs | 21-Nov-13 13:10 | 3 | -6 |

| Horse Racing / Winc 21st Nov : 2m Hcap Hrd | 21-Nov-13 12:50 | 4 | -8 |

| Horse Racing / Chep 21st Nov : 2m Nov Hrd | 21-Nov-13 12:40 | 1 | -2 |

| Horse Racing / MrktR 21st Nov : 2m3f Nov Hrd | 21-Nov-13 12:30 | 1 | -2 |

| Horse Racing / Wolv 19th Nov : 7f Hcap | 19-Nov-13 19:30 | 5 | -10 |

| Horse Racing / Wolv 19th Nov : 7f Hcap | 19-Nov-13 19:00 | 4 | -0.6 |

| Horse Racing / Wolv 19th Nov : 7f Hcap | 19-Nov-13 18:30 | 5 | 2.6 |

| Horse Racing / Wolv 19th Nov : 1m1f Hcap | 19-Nov-13 17:30 | 2 | 29.6 |

| Horse Racing / Wolv 19th Nov : 1m1f Hcap | 19-Nov-13 17:00 | 3 | 14.1 |

| Horse Racing / Wolv 19th Nov : 6f Mdn Stks | 19-Nov-13 16:30 | 1 | -2 |

| Horse Racing / Wolv 19th Nov : 6f Hcap | 19-Nov-13 16:00 | 1 | 3.5 |

| Horse Racing / Ling 19th Nov : 2m NHF | 19-Nov-13 15:50 | 1 | 6.6 |

| Horse Racing / Sthl 19th Nov : 6f Hcap | 19-Nov-13 15:40 | 4 | 1.7 |

| Horse Racing / Ling 19th Nov : 3m Hcap Chs | 19-Nov-13 15:20 | 1 | 4.7 |

| Horse Racing / Sthl 19th Nov : 6f Hcap | 19-Nov-13 15:10 | 4 | -8 |

| Horse Racing / Fake 19th Nov : 2m7f Hcap Hrd | 19-Nov-13 15:00 | 3 | 0.4 |

| Horse Racing / Ling 19th Nov : 2m Hcap Hrd | 19-Nov-13 14:50 | 3 | 12.2 |

| Horse Racing / Sthl 19th Nov : 6f Nursery | 19-Nov-13 14:40 | 6 | 2.7 |

| Horse Racing / Sthl 19th Nov : 1m Mdn Stks | 19-Nov-13 14:10 | 5 | 7.5 |

| Horse Racing / Fake 19th Nov : 2m Hcap Hrd | 19-Nov-13 14:00 | 2 | -4 |

| Horse Racing / Wolv 18th Nov : 1m4f Hcap | 18-Nov-13 17:00 | 6 | -12 |

| Horse Racing / Wolv 18th Nov : 7f Hcap | 18-Nov-13 16:30 | 3 | 16 |

| Horse Racing / Wolv 18th Nov : 7f Sell Stks | 18-Nov-13 16:00 | 1 | -2 |

| Horse Racing / Plump 18th Nov : 2m2f NHF | 18-Nov-13 15:50 | 2 | -4 |

| Horse Racing / Leic 18th Nov : 2m Nov Hrd | 18-Nov-13 15:40 | 3 | -6 |

| Horse Racing / Wolv 18th Nov : 2m Hcap | 18-Nov-13 15:30 | 7 | -5 |

| Horse Racing / Plump 18th Nov : 2m5f Hcap Hrd | 18-Nov-13 15:20 | 4 | -0.2 |

| Horse Racing / Leic 18th Nov : 2m4f Hcap Chs | 18-Nov-13 15:10 | 1 | -2 |

| Horse Racing / Wolv 18th Nov : 7f Mdn Stks | 18-Nov-13 15:00 | 2 | 1.1 |

| Horse Racing / Plump 18th Nov : 2m2f Hcap Hrd | 18-Nov-13 14:50 | 5 | 10.6 |

| Horse Racing / Leic 18th Nov : 2m Hcap Hrd | 18-Nov-13 14:40 | 4 | -0.8 |

| Horse Racing / Plump 18th Nov : 2m4f Hcap Chs | 18-Nov-13 14:20 | 2 | -4 |

| Horse Racing / Wolv 18th Nov : 1m1f Nursery | 18-Nov-13 14:00 | 2 | -4 |

| Horse Racing / Leic 18th Nov : 2m Sell Hrd | 18-Nov-13 13:35 | 1 | -2 |

| Horse Racing / Plump 18th Nov : 2m4f Nov Chs | 18-Nov-13 13:20 | 1 | -2 |

| Horse Racing / Plump 18th Nov : 2m Nov Hrd | 18-Nov-13 12:50 | 1 | -2 |

| Horse Racing / Leic 18th Nov : 2m Juv Hrd | 18-Nov-13 12:35 | 2 | -4 |

| Horse Racing / Uttox 16th Nov : 2m4f Hcap Hrd | 16-Nov-13 14:15 | 2 | -4 |

| Horse Racing / Weth 16th Nov : 3m1f Hcap Chs | 16-Nov-13 14:05 | 1 | -2 |

| Horse Racing / Ling 16th Nov : 1m Hcap | 16-Nov-13 14:00 | 3 | -6 |

| Horse Racing / Chelt 16th Nov : 3m3f Hcap Chs | 16-Nov-13 13:50 | 1 | 27.2 |

| Horse Racing / Weth 16th Nov : 3m1f Hcap Hrd | 16-Nov-13 13:30 | 5 | -10 |

| Horse Racing / Ling 16th Nov : 1m Nov Stks | 16-Nov-13 13:25 | 2 | -4 |

| Horse Racing / Chelt 16th Nov : 3m Nov Chs | 16-Nov-13 13:15 | 1 | -2 |

| Horse Racing / Weth 16th Nov : 2m Nov Chs | 16-Nov-13 12:55 | 1 | -2 |

| Horse Racing / Uttox 16th Nov : 2m Nov Hrd | 16-Nov-13 12:35 | 1 | -2 |

| Horse Racing / Wolv 12th Nov : 5f Hcap | 12-Nov-13 18:20 | 1 | -2 |

| Horse Racing / Newm 2nd Nov : 7f Hcap | 02-Nov-13 16:00 | 1 | -2 |

| Horse Racing / Weth 2nd Nov : 2m4f Hcap Hrd | 02-Nov-13 16:05 | 1 | -2 |

| Horse Racing / Ascot 2nd Nov : 2m Nov Hrd | 02-Nov-13 15:50 | 1 | -2 |

| Horse Racing / Ayr 2nd Nov : 2m Hcap Chs | 02-Nov-13 15:45 | 3 | 1.6 |

| Horse Racing / Weth 2nd Nov : 3m1f Grd2 Chs | 02-Nov-13 15:35 | 1 | -2 |

| Horse Racing / Ascot 2nd Nov : 3m Hcap Chs | 02-Nov-13 15:20 | 1 | -2 |

| Horse Racing / Ayr 2nd Nov : 2m Hcap Hrd | 02-Nov-13 15:10 | 3 | -6 |

| Horse Racing / Ascot 2nd Nov : 2m Hcap Hrd | 02-Nov-13 14:45 | 3 | 7 |

| Horse Racing / Newm 2nd Nov : 1m Hcap | 02-Nov-13 14:20 | 1 | -2 |

| Horse Racing / Ayr 2nd Nov : 3m1f Hcap Chs | 02-Nov-13 14:35 | 1 | -2 |

| Horse Racing / Ascot 2nd Nov : 2m1f Hcap Chs | 02-Nov-13 14:10 | 1 | -2 |

| Horse Racing / Ayr 2nd Nov : 2m4f Hcap Chs | 02-Nov-13 14:00 | 1 | -2 |

| Horse Racing / Weth 2nd Nov : 2m Listed Hrd | 02-Nov-13 13:50 | 1 | -2 |

| Horse Racing / Ascot 2nd Nov : 2m3f Hcap Chs | 02-Nov-13 13:35 | 2 | -4 |

| Horse Racing / Ayr 2nd Nov : 3m Hcap Hrd | 02-Nov-13 13:25 | 3 | -6 |

| Horse Racing / Kemp 23rd Oct : 7f Class Stks | 23-Oct-13 21:20 | 1 | -2 |

| Horse Racing / Kemp 23rd Oct : 7f Hcap | 23-Oct-13 20:50 | 2 | -4 |

| Horse Racing / Kemp 23rd Oct : 7f Nursery | 23-Oct-13 20:20 | 3 | 8.7 |

| Horse Racing / Kemp 23rd Oct : 1m Hcap | 23-Oct-13 19:50 | 3 | 2.8 |

| Horse Racing / Kemp 23rd Oct : 1m Mdn Stks | 23-Oct-13 19:20 | 3 | -6 |

| Horse Racing / Kemp 23rd Oct : 1m Mdn Stks | 23-Oct-13 18:50 | 2 | -4 |

| Horse Racing / Kemp 23rd Oct : 6f Mdn Stks | 23-Oct-13 18:20 | 4 | -0.4 |

| Horse Racing / Kemp 23rd Oct : 1m2f Hcap | 23-Oct-13 17:50 | 4 | 12.6 |

| Horse Racing / Worc 23rd Oct : 2m4f Hcap Hrd | 23-Oct-13 17:30 | 4 | -8 |

| Horse Racing / Worc 23rd Oct : 2m4f Mdn Hrd | 23-Oct-13 16:55 | 2 | 6.6 |

| Horse Racing / Font 23rd Oct : 2m6f Hcap Hrd | 23-Oct-13 16:30 | 3 | -6 |

| Horse Racing / Worc 23rd Oct : 2m Nov Hrd | 23-Oct-13 16:20 | 3 | -6 |

| Horse Racing / Newm 23rd Oct : 1m Mdn Stks | 23-Oct-13 16:10 | 1 | -2 |

| Horse Racing / Font 23rd Oct : 2m4f Beg Chs | 23-Oct-13 16:00 | 1 | -2 |

| Horse Racing / Font 23rd Oct : 2m2f Nov Hrd | 23-Oct-13 15:25 | 1 | -2 |

| Horse Racing / Worc 23rd Oct : 2m Hcap Chs | 23-Oct-13 15:15 | 1 | -2 |

| Horse Racing / Ponte 21st Oct : 1m2f Hcap | 21-Oct-13 17:40 | 1 | -2 |

| Horse Racing / Wind 21st Oct : 1m3f Hcap | 21-Oct-13 17:30 | 2 | 3.5 |

| Horse Racing / Plump 21st Oct : 2m5f Hcap Hrd | 21-Oct-13 17:20 | 1 | -2 |

| Horse Racing / Ponte 21st Oct : 1m2f Hcap | 21-Oct-13 17:10 | 1 | -2 |

| Horse Racing / Wind 21st Oct : 5f Hcap | 21-Oct-13 17:00 | 3 | -6 |

| Horse Racing / Plump 21st Oct : 2m1f Hcap Chs | 21-Oct-13 16:50 | 2 | -4 |

| Horse Racing / Ponte 21st Oct : 2m2f Hcap | 21-Oct-13 16:40 | 1 | -2 |

| Horse Racing / Wind 21st Oct : 1m2f Hcap | 21-Oct-13 16:30 | 1 | -2 |

| Horse Racing / Plump 21st Oct : 3m1f Hcap Hrd | 21-Oct-13 16:20 | 3 | 2.8 |

| Horse Racing / Ponte 21st Oct : 1m4f Mdn Stks | 21-Oct-13 16:10 | 1 | -2 |

| Horse Racing / Wind 21st Oct : 1m Hcap | 21-Oct-13 16:00 | 2 | -4 |

| Horse Racing / Wind 21st Oct : 1m Hcap | 21-Oct-13 15:30 | 2 | -4 |

| Horse Racing / Plump 21st Oct : 2m Hcap Hrd | 21-Oct-13 15:20 | 1 | -2 |

| Horse Racing / Ponte 21st Oct : 5f Hcap | 21-Oct-13 15:10 | 1 | -2 |

| Horse Racing / Plump 21st Oct : 2m4f Hcap Chs | 21-Oct-13 14:50 | 4 | 1.3 |

| Horse Racing / Ponte 21st Oct : 1m Nursery | 21-Oct-13 14:10 | 2 | -4 |

| Horse Racing / Plump 21st Oct : 2m Mdn Hrd | 21-Oct-13 14:20 | 1 | -2 |

| Horse Racing / Wolv 18th Oct : 7f Hcap | 18-Oct-13 21:00 | 3 | -6 |

| Horse Racing / Wolv 18th Oct : 7f Hcap | 18-Oct-13 20:30 | 2 | -4 |

| Horse Racing / Wolv 18th Oct : 7f Nursery | 18-Oct-13 20:00 | 4 | 6.1 |

| Horse Racing / Wolv 18th Oct : 1m1f Class Stks | 18-Oct-13 19:30 | 1 | -2 |

| Horse Racing / Wolv 18th Oct : 1m Sell Stks | 18-Oct-13 19:00 | 1 | -2 |

| Horse Racing / Wolv 18th Oct : 5f Nursery | 18-Oct-13 18:25 | 4 | 6.1 |

| Horse Racing / Wolv 18th Oct : 6f Mdn Stks | 18-Oct-13 17:55 | 5 | 16.3 |

| Horse Racing / Hayd 18th Oct : 2m Hcap | 18-Oct-13 17:40 | 1 | -2 |

| Horse Racing / Chelt 18th Oct : 2m Hcap Hrd | 18-Oct-13 17:30 | 5 | 16.1 |

| Horse Racing / Wolv 18th Oct : 6f Hcap | 18-Oct-13 17:25 | 6 | -1 |

| Horse Racing / Redc 18th Oct : 1m2f Hcap | 18-Oct-13 17:20 | 1 | -2 |

| Horse Racing / Hayd 18th Oct : 1m Hcap | 18-Oct-13 17:10 | 1 | -2 |

| Horse Racing / Chelt 18th Oct : 3m Hcap Chs | 18-Oct-13 17:00 | 1 | -2 |

| Horse Racing / Redc 18th Oct : 6f Mdn Stks | 18-Oct-13 16:50 | 1 | 23.7 |

| Horse Racing / Chelt 18th Oct : 2m Mdn Hrd | 18-Oct-13 16:25 | 1 | -2 |

| Horse Racing / Redc 18th Oct : 7f Hcap | 18-Oct-13 16:15 | 2 | -4 |

| Horse Racing / Hayd 18th Oct : 7f Mdn Stks | 18-Oct-13 16:05 | 1 | -2 |

| Horse Racing / Chelt 18th Oct : 3m Nov Chs | 18-Oct-13 15:50 | 4 | -8 |

| Horse Racing / Redc 18th Oct : 7f Hcap | 18-Oct-13 15:40 | 1 | -2 |

| Horse Racing / Redc 18th Oct : 1m6f Hcap | 18-Oct-13 15:05 | 1 | -2 |

| Horse Racing / Hayd 18th Oct : 5f Nursery | 18-Oct-13 14:55 | 1 | -2 |

| Horse Racing / Redc 18th Oct : 6f Mdn Stks | 18-Oct-13 14:30 | 1 | 29.6 |

| Horse Racing / Hayd 18th Oct : 1m2f Mdn Stks | 18-Oct-13 14:20 | 1 | -2 |

| Horse Racing / Chelt 18th Oct : 2m5f Nov Hrd | 18-Oct-13 14:10 | 1 | 6.5 |

| Horse Racing / Redc 18th Oct : 1m Mdn Stks | 18-Oct-13 13:30 | 1 | -2 |

| Horse Racing / Wind 14th Oct : 1m3f Hcap | 14-Oct-13 17:40 | 3 | 3.6 |

| Horse Racing / Salis 14th Oct : 1m6f Hcap | 14-Oct-13 17:30 | 1 | -2 |

| Horse Racing / Wind 14th Oct : 1m2f Hcap | 14-Oct-13 17:10 | 1 | -2 |

| Horse Racing / Salis 14th Oct : 1m2f Hcap | 14-Oct-13 17:00 | 1 | -2 |

| Horse Racing / Muss 14th Oct : 7f Hcap | 14-Oct-13 16:50 | 1 | -2 |

| Horse Racing / Wind 14th Oct : 1m Hcap | 14-Oct-13 16:40 | 1 | -2 |

| Horse Racing / Salis 14th Oct : 1m2f Hcap | 14-Oct-13 16:30 | 1 | 8.4 |

| Horse Racing / Muss 14th Oct : 5f Hcap | 14-Oct-13 16:20 | 2 | -4 |

| Horse Racing / Muss 14th Oct : 1m5f Hcap | 14-Oct-13 15:45 | 1 | -2 |

| Horse Racing / Wind 14th Oct : 6f Hcap | 14-Oct-13 15:35 | 1 | -2 |

| Horse Racing / Wind 14th Oct : 1m Mdn Stks | 14-Oct-13 15:05 | 1 | -2 |

| Horse Racing / Salis 14th Oct : 7f Mdn Stks | 14-Oct-13 14:50 | 1 | -2 |

| Horse Racing / Wind 14th Oct : 1m Nursery | 14-Oct-13 14:30 | 2 | 5.2 |

| Horse Racing / Muss 14th Oct : 5f Hcap | 14-Oct-13 14:10 | 1 | -2 |

| Horse Racing / Salis 14th Oct : 7f Mdn Stks | 14-Oct-13 13:50 | 1 | -2 |

| Horse Racing / Good 13th Oct : 1m Hcap | 13-Oct-13 17:45 | 1 | -2 |

| Horse Racing / FfosL 13th Oct : 2m NHF | 13-Oct-13 17:30 | 1 | -2 |

| Horse Racing / FfosL 13th Oct : 3m Hcap Hrd | 13-Oct-13 17:00 | 5 | 3.4 |

| Horse Racing / Good 13th Oct : 6f Hcap | 13-Oct-13 16:45 | 1 | -2 |

| Horse Racing / FfosL 13th Oct : 2m Hcap Hrd | 13-Oct-13 16:30 | 2 | -4 |

| Horse Racing / Good 13th Oct : 1m4f Hcap | 13-Oct-13 15:40 | 3 | -6 |

| Horse Racing / FfosL 13th Oct : 2m4f Hcap Hrd | 13-Oct-13 15:20 | 3 | -6 |

| Horse Racing / Good 13th Oct : 1m1f Mdn Stks | 13-Oct-13 15:05 | 1 | -2 |

| Horse Racing / FfosL 13th Oct : 2m5f Hcap Chs | 13-Oct-13 14:45 | 1 | -2 |

| Horse Racing / Good 13th Oct : 6f Mdn Stks | 13-Oct-13 14:30 | 1 | -2 |

| Horse Racing / FfosL 13th Oct : 2m Mdn Hrd | 13-Oct-13 14:15 | 1 | -2 |

| Horse Racing / Good 13th Oct : 2m Hcap | 13-Oct-13 14:00 | 1 | -2 |

| Bets this time | 449 | ||

| Winners this time | 54 | ||

| Strike rate this time | 12.03% | ||

| Profit this time (£) | -77.5 | ||

| Profit this time (points) | -38.75 |

I aim to be back around Christmas with my trial conclusion. 🙂

Update: 3rd January 2014

At last, a long overdue update from me on our intriguing BetHawk trial… And I have to say, it’s hard to dislike this product.

As I said last time, I do keep forgetting to run the bot in the morning (Note to self — must try harder!! — This is actually now on my New Year’s Resolutions List!) , but when I do, I find it remarkably drama-free.

BetHawk grows on you.

I think, for me, the issue with using a bot has been trust. But I am starting to believe my money is really safe with this thing.

So how are we doing?

Well, it’s a story of little ups and little downs, but the bottom line is an overall loss of 4.2 points after 1236 bets.

The good news is that we’ve made 4.05 points in 250 bets this time, to bring us almost back to the break-even point.

| Bets this time | 250 |

| Winners this time | 30 |

| Strike rate this time | 12.00% |

| Profit this time (£) | £8.10 |

| Profit this time (points) | 4.05 |

| Total bets so far | 1236 |

| Total winners | 169 |

| Strike rate for trial | 13.67% |

| Total profit (£) | -£8.40 |

| Total profit (points) | -4.20 |

I have to confess to worrying about that strike rate…

It’s the reason why I still feel a little nervous about switching the thing on!

But after over 1000 bets, I think it’s fair to say that confidence does start to build.

Maybe the secret with a tool like BetHawk is, ultimately, “faith”.

In precisely the way you must believe in a tipster before you place serious stakes on his selections, I’ve slowly had to learn to believe that my money is safe with this bizarre arrangement, of one software product (BetHawk) gambling my money with another software product (Betfair.com).

My log of results for the month of December is as follows.

| Market | Start time | Race Profit | Race Bets |

| Horse Racing / MrktR 26th Dec : 2m3f Hcap Hrd | 26-Dec-13 15:20 | -4 | 2 |

| Horse Racing / Font 26th Dec : 3m2f Hcap Chs | 26-Dec-13 15:20 | 2.3 | 3 |

| Horse Racing / Winc 26th Dec : 2m Hcap Chs | 26-Dec-13 15:25 | -2 | 1 |

| Horse Racing / Wolv 26th Dec : 1m1f Hcap | 26-Dec-13 15:15 | -4 | 2 |

| Horse Racing / Kemp 26th Dec : 3m Grd1 Chs | 26-Dec-13 15:10 | -2 | 1 |

| Horse Racing / Towc 26th Dec : 2m3f Hcap Chs | 26-Dec-13 15:05 | -2 | 1 |

| Horse Racing / Sedge 26th Dec : 2m4f Hcap Chs | 26-Dec-13 15:05 | 1.4 | 4 |

| Horse Racing / Weth 26th Dec : 2m4f Hcap Chs | 26-Dec-13 14:55 | -10 | 5 |

| Horse Racing / Winc 26th Dec : 3m1f Hcap Chs | 26-Dec-13 14:50 | -6 | 3 |

| Horse Racing / Font 26th Dec : 2m2f Hcap Hrd | 26-Dec-13 14:45 | -8 | 4 |

| Horse Racing / MrktR 26th Dec : 2m2f Hcap Chs | 26-Dec-13 14:45 | 6.7 | 2 |

| Horse Racing / Wolv 26th Dec : 1m Nursery | 26-Dec-13 14:40 | 4.5 | 2 |

| Horse Racing / Towc 26th Dec : 2m5f Hcap Hrd | 26-Dec-13 14:30 | -2 | 1 |

| Horse Racing / Sedge 26th Dec : 2m1f Hcap Hrd | 26-Dec-13 14:30 | -8 | 4 |

| Horse Racing / Weth 26th Dec : 2m6f Hcap Hrd | 26-Dec-13 14:20 | -6 | 3 |

| Horse Racing / Bang 22nd Dec : 2m1f NHF | 22-Dec-13 15:40 | -4 | 2 |

| Horse Racing / Ling 22nd Dec : 6f Hcap | 22-Dec-13 15:30 | 2.3 | 6 |

| Horse Racing / Bang 22nd Dec : 3m Hcap Hrd | 22-Dec-13 15:10 | -6 | 3 |

| Horse Racing / Ling 22nd Dec : 2m Hcap | 22-Dec-13 15:00 | 7.6 | 4 |

| Horse Racing / Ling 22nd Dec : 7f Hcap | 22-Dec-13 14:30 | -6 | 3 |

| Horse Racing / Bang 22nd Dec : 2m4f Nov Hrd | 22-Dec-13 14:10 | -2 | 1 |

| Horse Racing / Ling 22nd Dec : 1m Hcap | 22-Dec-13 14:00 | -8 | 4 |

| Horse Racing / Ling 22nd Dec : 1m Mdn Stks | 22-Dec-13 13:30 | -2 | 1 |

| Horse Racing / Bang 22nd Dec : 3m Hcap Chs | 22-Dec-13 13:10 | -0.5 | 4 |

| Horse Racing / Bang 22nd Dec : 2m4f Hcap Chs | 22-Dec-13 12:40 | -4 | 2 |

| Horse Racing / Hayd 21st Dec : 3m Hcap Chs | 21-Dec-13 14:05 | -2 | 1 |

| Horse Racing / Ling 21st Dec : 1m Cond Stks | 21-Dec-13 14:00 | -2 | 1 |

| Horse Racing / Ascot 21st Dec : 2m1f Hcap Chs | 21-Dec-13 13:50 | -6 | 3 |

| Horse Racing / Newc 21st Dec : 2m4f Hcap Chs | 21-Dec-13 13:40 | -4 | 2 |

| Horse Racing / Hayd 21st Dec : 2m Hcap Chs | 21-Dec-13 13:30 | -2 | 1 |

| Horse Racing / Ling 21st Dec : 5f Hcap | 21-Dec-13 13:25 | -8 | 4 |

| Horse Racing / Newc 21st Dec : 2m Hcap Hrd | 21-Dec-13 13:10 | 19.8 | 2 |

| Horse Racing / Hayd 21st Dec : 2m4f Listed Hrd | 21-Dec-13 13:00 | -4 | 2 |

| Horse Racing / Kemp 18th Dec : 6f Mdn Stks | 18-Dec-13 17:50 | -4 | 2 |

| Horse Racing / Kemp 18th Dec : 7f Sell Stks | 18-Dec-13 17:20 | -2 | 1 |

| Horse Racing / Kemp 18th Dec : 5f Hcap | 18-Dec-13 16:50 | 8.5 | 5 |

| Horse Racing / Wolv 16th Dec : 1m Hcap | 16-Dec-13 17:10 | 4 | 4 |

| Horse Racing / Wolv 16th Dec : 1m Mdn Stks | 16-Dec-13 16:40 | -6 | 3 |

| Horse Racing / Wolv 16th Dec : 1m1f Mdn Stks | 16-Dec-13 16:10 | -2 | 1 |

| Horse Racing / FfosL 16th Dec : 2m NHF | 16-Dec-13 15:50 | -2 | 1 |

| Horse Racing / Wolv 16th Dec : 1m Claim Stks | 16-Dec-13 15:40 | 8.3 | 1 |

| Horse Racing / Plump 16th Dec : 2m Hcap Hrd | 16-Dec-13 15:30 | 6.3 | 3 |

| Horse Racing / FfosL 16th Dec : 2m Hcap Hrd | 16-Dec-13 15:15 | -4 | 2 |

| Horse Racing / Wolv 16th Dec : 1m6f Hcap | 16-Dec-13 15:05 | 8.7 | 3 |

| Horse Racing / Plump 16th Dec : 2m4f Hcap Chs | 16-Dec-13 14:55 | -2 | 1 |

| Horse Racing / FfosL 16th Dec : 3m1f Hcap Chs | 16-Dec-13 14:40 | -2 | 1 |

| Horse Racing / Wolv 16th Dec : 1m4f Sell Stks | 16-Dec-13 14:30 | -2 | 1 |

| Horse Racing / Wolv 9th Dec : 1m Hcap | 09-Dec-13 17:10 | -10 | 5 |

| Horse Racing / Wolv 9th Dec : 1m1f Hcap | 09-Dec-13 16:40 | 3.8 | 1 |

| Horse Racing / Wolv 9th Dec : 1m4f Hcap | 09-Dec-13 16:10 | -2 | 1 |

| Horse Racing / Wolv 9th Dec : 6f Hcap | 09-Dec-13 15:40 | -6 | 3 |

| Horse Racing / Ling 9th Dec : 6f Hcap | 09-Dec-13 15:30 | -8 | 4 |

| Horse Racing / Muss 9th Dec : 2m NHF | 09-Dec-13 15:20 | -4 | 2 |

| Horse Racing / Wolv 9th Dec : 1m6f Hcap | 09-Dec-13 15:10 | -4 | 2 |

| Horse Racing / Ling 9th Dec : 1m Hcap | 09-Dec-13 15:00 | -8 | 4 |

| Horse Racing / Muss 9th Dec : 3m Hcap Chs | 09-Dec-13 14:50 | 11.4 | 2 |

| Horse Racing / Wolv 9th Dec : 6f Nursery | 09-Dec-13 14:40 | 4 | 4 |

| Horse Racing / Ling 9th Dec : 1m2f Hcap | 09-Dec-13 14:30 | -4 | 2 |

| Horse Racing / Muss 9th Dec : 2m4f Hcap Hrd | 09-Dec-13 14:20 | -4 | 2 |

| Horse Racing / Ling 9th Dec : 7f Claim Stks | 09-Dec-13 14:00 | -2 | 1 |

| Horse Racing / Muss 9th Dec : 3m Hcap Hrd | 09-Dec-13 13:45 | -2 | 1 |

| Horse Racing / Ling 9th Dec : 5f Hcap | 09-Dec-13 13:30 | 0 | 2 |

| Horse Racing / Kelso 8th Dec : 3m3f Hcap Hrd | 08-Dec-13 15:25 | -2 | 1 |

| Horse Racing / Warw 8th Dec : 2m5f Hcap Hrd | 08-Dec-13 15:10 | -4 | 2 |

| Horse Racing / Kelso 8th Dec : 2m6f Nov Hrd | 08-Dec-13 14:55 | -0.1 | 3 |

| Horse Racing / Warw 8th Dec : 3m5f Hcap Chs | 08-Dec-13 14:40 | -6 | 3 |

| Horse Racing / Kelso 8th Dec : 2m7f Hcap Chs | 08-Dec-13 14:25 | 4.7 | 3 |

| Horse Racing / Warw 8th Dec : 2m5f Mdn Hrd | 08-Dec-13 14:10 | -2 | 1 |

| Horse Racing / Kelso 8th Dec : 4m Hcap Chs | 08-Dec-13 13:55 | 5.2 | 5 |

| Horse Racing / Warw 8th Dec : 2m Hcap Chs | 08-Dec-13 13:40 | -12 | 6 |

| Horse Racing / Kelso 8th Dec : 2m Hcap Hrd | 08-Dec-13 13:25 | -6 | 3 |

| Horse Racing / Warw 8th Dec : 2m Juv Hrd | 08-Dec-13 12:40 | -2 | 1 |

| Horse Racing / Wolv 7th Dec : 2m Hcap | 07-Dec-13 21:20 | 13.5 | 2 |

| Horse Racing / Wolv 7th Dec : 6f Nursery | 07-Dec-13 20:50 | 12 | 4 |

| Horse Racing / Wolv 7th Dec : 1m6f Hcap | 07-Dec-13 20:20 | 7.4 | 3 |

| Horse Racing / Wolv 7th Dec : 7f Mdn Stks | 07-Dec-13 19:50 | 1.5 | 4 |

| Horse Racing / Wolv 7th Dec : 1m4f Mdn Stks | 07-Dec-13 19:20 | -0.1 | 2 |

| Horse Racing / Wolv 7th Dec : 1m Hcap | 07-Dec-13 18:50 | -2 | 1 |

| Horse Racing / Wolv 7th Dec : 7f Hcap | 07-Dec-13 18:20 | -0.9 | 3 |

| Horse Racing / Chep 7th Dec : 2m NHF | 07-Dec-13 15:45 | -2 | 1 |

| Horse Racing / Sand 7th Dec : 3m5f Hcap Chs | 07-Dec-13 15:35 | 19 | 1 |

| Horse Racing / Aint 7th Dec : 2m5f Hcap Chs | 07-Dec-13 15:15 | -2 | 1 |

| Horse Racing / Chep 7th Dec : 2m3f Hcap Chs | 07-Dec-13 15:10 | -6 | 3 |

| Horse Racing / Sand 7th Dec : 2m Grd1 Chs | 07-Dec-13 15:00 | -2 | 1 |

| Horse Racing / Weth 7th Dec : 3m1f Hcap Chs | 07-Dec-13 14:50 | 4.9 | 3 |

| Horse Racing / Chep 7th Dec : 3m Hcap Hrd | 07-Dec-13 14:35 | -2 | 1 |

| Horse Racing / Sand 7th Dec : 2m Hcap Hrd | 07-Dec-13 14:25 | -2 | 1 |

| Horse Racing / Weth 7th Dec : 2m Hcap Hrd | 07-Dec-13 14:15 | 0.1 | 4 |

| Horse Racing / Chep 7th Dec : 3m Hcap Chs | 07-Dec-13 14:00 | 5.1 | 3 |

| Horse Racing / Sand 7th Dec : 2m Nov Chs | 07-Dec-13 13:50 | -2 | 1 |

| Horse Racing / Weth 7th Dec : 2m Hcap Chs | 07-Dec-13 13:40 | -2 | 1 |

| Horse Racing / Aint 7th Dec : 2m4f Hcap Hrd | 07-Dec-13 13:30 | 21.8 | 2 |

| Horse Racing / Sand 7th Dec : 2m6f Hcap Hrd | 07-Dec-13 13:20 | -2 | 1 |

| Horse Racing / Weth 7th Dec : 3m1f Hcap Hrd | 07-Dec-13 13:10 | 13.9 | 4 |

| Horse Racing / Aint 7th Dec : 2m4f Hcap Hrd | 07-Dec-13 13:00 | -4 | 2 |

| Horse Racing / Chep 7th Dec : 3m Hcap Chs | 07-Dec-13 12:55 | -4 | 2 |

| Horse Racing / Sand 7th Dec : 2m4f Hcap Hrd | 07-Dec-13 12:50 | -2 | 1 |

| Horse Racing / Weth 7th Dec : 2m4f Hcap Chs | 07-Dec-13 12:40 | -2 | 1 |

| Horse Racing / Chep 7th Dec : 2m4f Nov Hrd | 07-Dec-13 12:25 | -2 | 1 |

| Horse Racing / Sand 7th Dec : 2m Nov Hrd | 07-Dec-13 12:20 | 6.6 | 2 |

| Horse Racing / Weth 7th Dec : 2m6f Nov Hrd | 07-Dec-13 12:10 | 42.1 | 1 |

| Horse Racing / Wolv 2nd Dec : 1m6f Hcap | 02-Dec-13 12:55 | 40.3 | 3 |

| Horse Racing / Wolv 29th Nov : 5f Hcap | 29-Nov-13 18:55 | -10 | 5 |

| Horse Racing / Wolv 29th Nov : 7f Hcap | 29-Nov-13 18:25 | -8 | 4 |

| Horse Racing / Wolv 29th Nov : 1m Hcap | 29-Nov-13 17:55 | -4 | 2 |

| Horse Racing / Kemp 28th Nov : 1m Mdn Stks | 28-Nov-13 17:35 | 0 | 2 |

| Totals | 8.1 | 250 |

I was going to wind the trial up this time, but, in its current state, I feel things are inconclusive. And it’s obvious to me that the whole point of this product – almost more than anything else on my site – is long term investment.

So I’m pushing on.

I’ll be back with my next report around the start of February.

Update: 28th January 2014

I thought I’d take a slightly different tack with BetHawk in January. Like, you know, switch it on.

Regular readers will know that I’m a bit of a coward where bots are concerned.

As someone once said to me in a wholly other context: I have trust issues.

Now this may be neither the time nor the place to start unloading childhood angst (er, I’m only messing here, I’m fine, really!), but frankly, things came to a head when, after my last report, the BetHawk system salesman ran out of patience with me being too timid to run his bot, to the point where he started publishing his own results on my site!

OK OK! I can take a hint!

And anyway, as I explained last time, BetHawk grows on you.

I’m starting to believe, OK!?

So this time, I’ve been switching the thing on. Most days, even! And I’ve added almost 600 more bets! And guess what..!

I made a heap of money!

The Story In Numbers

We came into January on the back of a mildly profitable December, still slightly overdrawn – to the tune of 4.2 points, to be precise.

However, we approach the end of January, 581 bets further down the line, in far better shape.

Look at this!

| Bets this time | 581 |

| Winners this time | 83 |

| Strike rate this time | 14.3% |

| Profit this time (£) | £ 74.01 |

| Profit this time (points) | 37.01 |

| Total bets so far | 1817 |

| Total winners | 252 |

| Strike rate for trial | 13.9% |

| Total profit (£) | £ 65.61 |

| Total profit (points) | 32.81 |

And you know, I’m even starting to worry less about that strike rate….

After all, it’s rock solid.

14% is what it is, and 14% is what you are going to get.

And that isn’t a problem provided you let the thing run for long enough.

Now I know this is going to sound weirdly superstitious, but…. I find BetHawk works even better if you ignore it!

Seriously!

The days I sit and mither over the thing, it just won’t leave the station, but sits there sulking, losing my money.

Whereas when I forget all about it… it steams silently from one race track to another, like a bullet train of profit.

OK OK, back to the serious stuff… Results log time!

If there is one thing that builds trust, it’s data. And after 1,817 bets, we’ve now got plenty!

So here follows (deep breath) a summary of the 581 bets I (well, it) placed in January:

| Market | Start time | Race Profit | Race Bets |

| Horse Racing / Donc 8th Jan : 2m3f Mdn Hrd | 08-Jan-14 12:10 | -2 | 1 |

| Horse Racing / Ling 8th Jan : 6f Hcap | 08-Jan-14 12:30 | -2 | 1 |

| Horse Racing / Donc 8th Jan : 2m Hcap Hrd | 08-Jan-14 12:40 | 7.4 | 3 |

| Horse Racing / Ling 8th Jan : 5f Hcap | 08-Jan-14 13:00 | -8 | 4 |

| Horse Racing / Donc 8th Jan : 2m3f Mdn Hrd | 08-Jan-14 13:10 | 6.27 | 2 |

| Horse Racing / Ling 8th Jan : 1m2f Hcap | 08-Jan-14 13:30 | -2 | 1 |

| Horse Racing / Donc 8th Jan : 2m3f Nov Chs | 08-Jan-14 13:40 | 4.3 | 1 |

| Horse Racing / Ling 8th Jan : 1m2f Hcap | 08-Jan-14 14:00 | -4 | 2 |

| Horse Racing / Donc 8th Jan : 2m Nov Hrd | 08-Jan-14 14:10 | -4 | 2 |

| Horse Racing / Ling 8th Jan : 1m2f Mdn Stks | 08-Jan-14 14:35 | -2 | 1 |

| Horse Racing / Donc 8th Jan : 3m Hcap Chs | 08-Jan-14 14:45 | -12 | 6 |

| Horse Racing / Ling 8th Jan : 6f Hcap | 08-Jan-14 15:10 | -4 | 2 |

| Horse Racing / Donc 8th Jan : 2m3f Hcap Hrd | 08-Jan-14 15:20 | -2 | 1 |

| Horse Racing / Ling 8th Jan : 1m Hcap | 08-Jan-14 15:40 | -8 | 4 |

| Horse Racing / Donc 8th Jan : 3m Hcap Hrd | 08-Jan-14 15:50 | -4 | 2 |

| Horse Racing / Kemp 8th Jan : 1m2f Hcap | 08-Jan-14 16:10 | 11.6 | 3 |

| Horse Racing / Kemp 8th Jan : 5f Hcap | 08-Jan-14 16:40 | 9.1 | 4 |

| Horse Racing / Kemp 8th Jan : 7f Hcap | 08-Jan-14 17:10 | -2 | 1 |

| Horse Racing / Kemp 8th Jan : 6f Hcap | 08-Jan-14 18:10 | -14 | 7 |

| Horse Racing / Kemp 8th Jan : 7f Hcap | 08-Jan-14 18:40 | -4.4 | 5 |

| Horse Racing / Kemp 8th Jan : 1m4f Hcap | 08-Jan-14 19:10 | 4.2 | 3 |

| Horse Racing / Catt 9th Jan : 2m Juv Hrd | 09-Jan-14 12:35 | -2 | 1 |

| Horse Racing / Sthl 9th Jan : 5f Mdn Stks | 09-Jan-14 13:20 | -6 | 3 |

| Horse Racing / Sthl 9th Jan : 6f Hcap | 09-Jan-14 13:50 | 6.6 | 3 |

| Horse Racing / Catt 9th Jan : 2m Nov Hrd | 09-Jan-14 14:05 | -4 | 2 |

| Horse Racing / Sthl 9th Jan : 1m Hcap | 09-Jan-14 14:20 | 5.3 | 3 |

| Horse Racing / Catt 9th Jan : 3m6f Hcap Chs | 09-Jan-14 14:35 | 6.6 | 2 |

| Horse Racing / Sthl 9th Jan : 1m3f Mdn Stks | 09-Jan-14 14:50 | -2 | 1 |

| Horse Racing / Catt 9th Jan : 2m3f Hcap Hrd | 09-Jan-14 15:05 | 30.78 | 3 |

| Horse Racing / Sthl 9th Jan : 5f Hcap | 09-Jan-14 15:20 | -6 | 3 |

| Horse Racing / Catt 9th Jan : 2m NHF | 09-Jan-14 15:35 | -6 | 3 |

| Horse Racing / Sthl 9th Jan : 1m3f Hcap | 09-Jan-14 15:50 | -10 | 5 |

| Horse Racing / Wolv 9th Jan : 1m Hcap | 09-Jan-14 16:40 | -4 | 2 |

| Horse Racing / Ling 10th Jan : 5f Hcap | 10-Jan-14 12:30 | 4.9 | 1 |

| Horse Racing / Ling 10th Jan : 1m4f Mdn Stks | 10-Jan-14 13:00 | 3.71 | 1 |

| Horse Racing / Sedge 10th Jan : 2m6f Hcap Chs | 10-Jan-14 13:15 | -2 | 1 |

| Horse Racing / Ling 10th Jan : 1m2f Hcap | 10-Jan-14 13:30 | -4 | 2 |

| Horse Racing / Sedge 10th Jan : 2m1f Hcap Hrd | 10-Jan-14 13:45 | -2 | 1 |

| Horse Racing / Ling 10th Jan : 7f Mdn Stks | 10-Jan-14 15:00 | -2 | 1 |

| Horse Racing / Sedge 10th Jan : 2m4f Hcap Hrd | 10-Jan-14 15:15 | -4 | 2 |

| Horse Racing / Ling 10th Jan : 1m4f Hcap | 10-Jan-14 15:30 | -4 | 2 |

| Horse Racing / Wolv 10th Jan : 6f Hcap | 10-Jan-14 16:00 | -2 | 1 |

| Horse Racing / Wolv 10th Jan : 6f Hcap | 10-Jan-14 16:30 | -2 | 1 |

| Horse Racing / Wolv 10th Jan : 1m6f Hcap | 10-Jan-14 17:00 | -2 | 1 |

| Horse Racing / Wolv 10th Jan : 1m4f Claim Stks | 10-Jan-14 17:30 | -2 | 1 |

| Horse Racing / Wolv 10th Jan : 1m4f Hcap | 10-Jan-14 18:00 | 5.1 | 2 |

| Horse Racing / Wolv 10th Jan : 7f Hcap | 10-Jan-14 18:30 | 23.6 | 2 |

| Horse Racing / Wolv 12th Jan : 5f Hcap | 12-Jan-14 13:30 | -2 | 1 |

| Horse Racing / Wolv 12th Jan : 5f Hcap | 12-Jan-14 14:00 | -1 | 3 |

| Horse Racing / Wolv 12th Jan : 1m4f Mdn Stks | 12-Jan-14 14:30 | 9.7 | 2 |

| Horse Racing / Wolv 12th Jan : 1m1f Hcap | 12-Jan-14 15:00 | -6 | 3 |

| Horse Racing / Wolv 12th Jan : 7f Hcap | 12-Jan-14 16:00 | -4 | 2 |

| Horse Racing / Sthl 14th Jan : 7f Hcap | 14-Jan-14 12:40 | -6 | 3 |

| Horse Racing / Extr 14th Jan : 2m1f Hcap Chs | 14-Jan-14 12:55 | -8 | 4 |

| Horse Racing / Sthl 14th Jan : 1m Hcap | 14-Jan-14 13:10 | -2 | 1 |

| Horse Racing / Extr 14th Jan : 2m3f Nov Hrd | 14-Jan-14 13:25 | -4 | 2 |

| Horse Racing / Sthl 14th Jan : 1m Hcap | 14-Jan-14 13:45 | 16.1 | 3 |

| Horse Racing / Extr 14th Jan : 2m3f Nov Hrd | 14-Jan-14 14:00 | -2 | 1 |

| Horse Racing / Ling 15th Jan : 2m Claim Stks | 15-Jan-14 12:30 | -2 | 1 |